AIM13 Commentary - 2020 Q1

“If you’re going through hell, keep going.”

We sincerely hope that this letter finds you safe and well. Expressions of concern during this difficult time have become so commonplace that they run the risk of becoming rote and losing their meaning and impact. The daily heartbreaking stories can almost leave one numb to the human tragedy of the COVID-19 pandemic. For those of us directly touched by loss and illness, the disease on a human level is devastating, to say nothing of the economic impact in terms of lost jobs and businesses. Please know we here at AIM always put the health and well-being of our partners and employees as our number one priority.

Earlier this year, we wrote in our fourth quarter letter that “the discipline required to maintain a focus on risk is difficult for most investors to sustain,” especially with the S&P 500 Total Return index (“S&P 500 TR”) up over 31% in 2019. However, as the last couple of months have demonstrated, risk is a constant, and the only way to achieve long term investment objectives is to be prepared and stick to a plan that recognizes risk exists – and above all “keep going” when things get tough. A plan must also factor in the probabilities of risks, from the mild to the most severe, be nimble and adaptable, and avoid emotion-driven decisions. The challenge is making decisions in a world crowded with so-called experts and no shortage of predictions. This crisis in particular has exposed both how little we know about certain things, and equally how quick many are to profess knowledge and believe they can predict the future.

As we now find ourselves in an environment with once almost unimaginable dislocations (including a roll of toilet paper costing more than a future barrel of oil!), looking back over the past six months illustrates just how quickly things changed from the calm to the storm:

With dramatic movement in the market on a daily and even hourly basis, we need to constantly remind ourselves of the importance of maintaining a long-term view. Since testing a low on March 23rd, the S&P 500 TR is up over 25% as of the writing of this letter. In fact, the S&P 500 TR is only off about 17% from its high on February 19th. We expect to see more volatility and uncertainty for many months, even potentially years, to come. We believe most people are underestimating how challenging the investing environment will be for the foreseeable future, and how long this will last. As Inigo Fraser Jenkins, co-head of portfolio strategy at Bernstein Research, wrote recently, “[G]iven we are facing the deepest recession and highest unemployment rate since the war, and equities were not exactly cheap before the virus hit, we think it unlikely that we get away with ‘only’ a 15% fall in the S&P.”

Reflecting on all we have gone through over the last few months, some people say this time is not different and that this period of volatility will soon pass with a return to “normal” imminent. We disagree. We believe it highly likely we are experiencing a pivotal, once-in-a-generation shift, and we will feel the effects, both known and unknown, for years to come. We believe it is especially critical at times like these to be prepared, focus on facts, and remove emotion from decision-making. The current crisis has caused us to revisit these principles and think about how can we learn and adapt for the future:

Be prepared. People have mocked us in the past for storing masks, disinfectant wipes, emergency “go bags,” WaterBobs, and defibrillators in our homes and offices. Some view it as extreme, accusing us of being paranoid or doomsayers, or even panicking. However, we think being prepared is just a simple, calculated decision. Why wouldn’t you buy masks when the upside (probable health benefits) greatly outweighs the downside (cost)? It is a lot easier to prepare for the crisis ahead of time than wait until everyone is running to the market and buying up toilet paper. Indeed, in February and early March, we had some heated conversations with good friends about buying masks and disinfectants. The reality is that many people downplayed the risks and ignored the signals, either out of wishful ignorance or just selfish convenience.

Focus on facts and act on warning signs. According to a recent PEW poll, 48% of Americans have heard false information about COVID-19. It has gotten so bad that FEMA was forced to set up a “Coronavirus Rumor Control” page on its website to “help the public distinguish between rumors and facts.”

“When the eagles are silent, the parrots begin to jabber.”

In times like this, when there is a lot of uncertainty, it seems everyone is an expert who can predict the future even though facts are seemingly in short supply. There is certainly a lot we do not know about this virus, however the threat of a pandemic is not new. President George W. Bush warned us in 2005, “If we wait for a pandemic to appear, it will be too late to prepare.” President Obama essentially repeated the same warning in a speech at the NIH on December 2, 2014. In the same vein, we are now all aware of Bill Gates’s TED talk in 2015.

Our partner, Ambassador Henry Crumpton, has been familiar with pandemic risks since 1998, when he began working on the biological warfare threat in the context of the U.S. counterterrorism mission. His efforts included disrupting al-Qa’ida’s efforts to weaponize anthrax, and other operations, all aimed at mass destruction by viral or bacterial means. In 2006, he brought his intelligence experience to the policy community when, as the U.S. Coordinator for Counterterrorism, he co-chaired an international conference (BLACK ICE) that further explored bioterrorism, including the actors, the weapons and the implications of terrorist acts.

The facts were there, but unfortunately many people chose to ignore them. These facts, however, made us realize that spending a relatively small amount of money in years past on cases of disinfectant wipes and masks or keeping our kids home from school before the schools closed in mid-March made sense.

Limit emotion – both on the negative and positive side. We understand the need for optimism and the dangers of pessimism. We would not be raising families if we did not believe in a brighter future. This does not mean, however, that what we feel about something should dictate how we act. As we wrote in our last letter, we must guard against vacillations in our behaviors and outlook – either overly rosy or excessively guarded.

“The degree of one’s emotions varies inversely with one’s knowledge of the facts.”

At this moment of stress for everyone, the risk of emotion-driven decisions is especially high. With the swings between positive and negative news happening on an almost hourly basis, it is imperative to keep on an even keel and to make fact-based decisions.

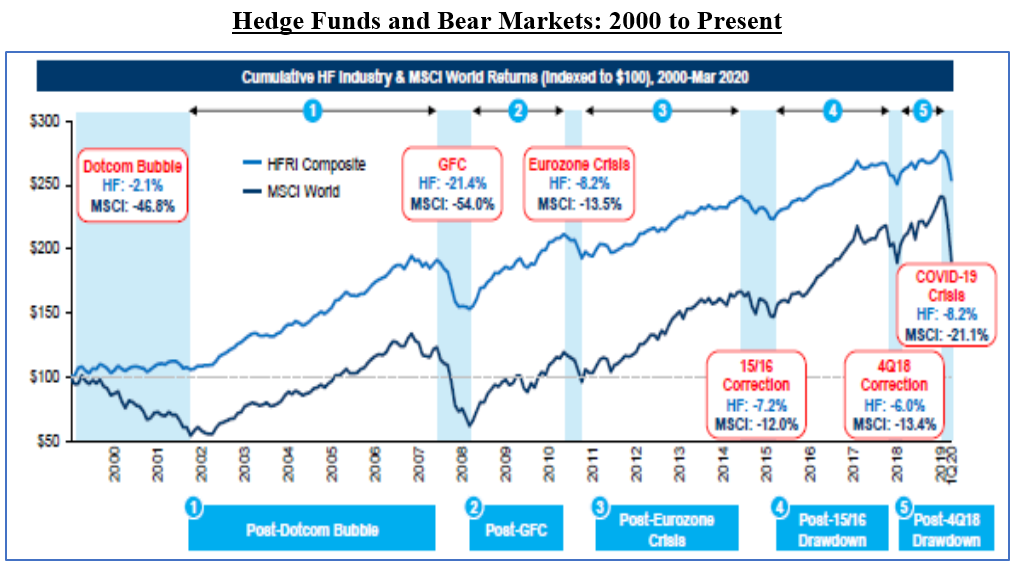

We apply these same principles to our investments. First and foremost, we have prepared a portion of our overall portfolio for a downturn. Our personal investments are not all in hedged investments. However, they are a meaningful part of our total portfolio because truly “hedged” funds have demonstrated portfolio protection benefits. Over the last twenty years, hedge funds have mitigated downside risk during the two bear markets (2001 and 2008) and three bull market corrections (2011, 2015, and 2018):

Source: Barclays

We also try to be nimble and opportunistic, making investment decisions based on facts, not emotions. Last July, informed by Ambassador Crumpton’s work on pandemics, we partnered with the Crumpton team to make an investment from our private equity program in a company that makes a revolutionary, “always-on” antimicrobial coating. The product provides continuous surface protection against viruses and bacteria across public spaces. Just as we have been concerned about pandemics, we also believe a major cyberattack is highly probable, if not imminent. We have spent a lot of time thinking about how to prepare, engaging specialists to advise us on our firm’s cybersecurity, conducting audits and investing in technology. We also made a direct investment from one of our private equity funds in a cybersecurity company that provides pro-active cyber threat interference. We hope no one ever needs the company’s solutions, but the facts of the ransomware attack in Henry County, Tennessee in 2016 (which forced responders to track emergency calls with pencil and paper for three days as their system was rebuilt) or at hospitals, and even at asset managers we know, tell us that cybersecurity must be a high priority for every municipality, business and individual – and investor.

Our emphasis on hedged strategies and these focused investments is not about “panicking” or being “paranoid” or a “doomsayer.” We make investments because there is a meaningful probability of something happening – whether it be a pandemic that wipes away $16 trillion from the global markets or a cyberattack on an individual firm. If there is a real probability of sudden cardiac arrest, does not having a defibrillator increase the chance of survival? The upside is tremendous, and the downside (cost) is minimal. We very much hope that having a hedged portfolio or a defibrillator or even insurance is a waste of money. However, when you look at the facts and history, risks do materialize and being protected from loss, personal and financial, makes sense over the long term. This is not about being overly pessimistic. Indeed, we continue to find compelling investments, and we are optimistic about our country’s ability to get through the present crisis. However, just as being always pessimistic is not good, neither is relying on hope as an investment strategy.

* * *

“We can’t prevent market panics. We can control how we react.”

We have been shocked and deeply disappointed in many discussions we have had about people’s response to the current pandemic. In particular, we are extremely upset by people who have ignored calls to wear masks. If someone is not willing to wear a simple mask, balancing the discomfort against the social benefits of potentially helping all of us get through this faster or even saving a single life, we can only conclude that some people are just selfish.

We thought about this recently when we came across the phenomenon of “psychological reactance.” The behavioral economist, Syon Bhanot, described it recently this way: “When someone tells you how to behave, you feel your liberty threatened and ‘lash out’ not only by ignoring the advice but by leaning into behavior that goes against what is being suggested.” To us, this is classic decision-making process based upon emotions, not facts. If there has been proof that there is a high likelihood that social distancing, masks, etc. may prevent the spread of the disease, then we go back to the question, why wouldn’t you do it? While we do respect and understand people’s liberties, we do not understand not taking a step that potentially can save others.

As we noted above, the world has changed. As important as it is to be responsible, it is also important that we get people back to work. The way we do that is through responsible behavior. This is not an “and/or” problem. We can re-open the economy, and we can be safe doing it. We are bullish about America, and we are optimistic that we will get through this. The courage and the will of those on the frontlines reaffirms our belief that our country and the world will emerge from this crisis stronger and smarter.

“It’s not enough that we do our best; sometimes we have to do what’s required.”

Due Diligence Tip: Cybersecurity in a Remote World

An under-reported consequence of so many of us working remotely is the proliferation of cyberattacks, including ransomware and theft directed at investment managers. On April 8, 2020, CISA, the cybersecurity arm of the U.S. Department of Homeland Security, issued a joint alert with the U.K.’s National Cyber Security Centre warning people about COVID-19 exploitation by hackers. The SEC has also taken notice and is currently conducting a limited sweep of registered investment advisers to ensure that firms are focused on cybersecurity as a component of their business continuity plans. With cybersecurity especially important right now, we wanted to share some risks we see uniquely associated with telecommuting:

Use of virtual private networks (VPNs): Many firms use VPNs to connect remote employees to the enterprise network. While these “tunnels” are viewed as secure, what are not necessarily secure are the endpoint devices used by employees. Many employees do not have firm-issued hardware (laptops or home computers), and outdated firewalls or embedded malware on those devices create an opening for a hacker to access the network through those devices. If a firm cannot ensure security at the access points, the better alternative is to use a virtual desktop provider, such as Citrix, which create secure environments on remote hardware.

Home WiFi: Many people do not have password-protection on their home WiFi networks or have connected hardware (such as a wireless printer) that is not secure. All WiFi networks should be protected with strong passwords that are routinely changed. Hackers are known to visit buildings and neighborhoods, including wealthy enclaves, looking for unsecured networks. You should also disable the “auto-connect” function, since hackers use that to cause your device to connect to their network disguised as one with the same name as one you have used in the past.

Creative phishing and “harpooning” attacks: Hackers are now using Zoom meeting invites, email notifications regarding IRS relief payments, and alerts about COVID-19 to trick employees into clicking links and opening up networks to theft and ransomware. Hackers have also been registering new domain names containing wording related to the pandemic. (Since January 2020, there have been over 4,000 coronavirus-related domains registered globally with 3% found to be malicious and an additional 5% suspicious, according to Checkpoint.) Some of the attacks are “harpooning” strategies, which target C-suite employees (such as CFOs) to share bank information or issue invoices from service providers.

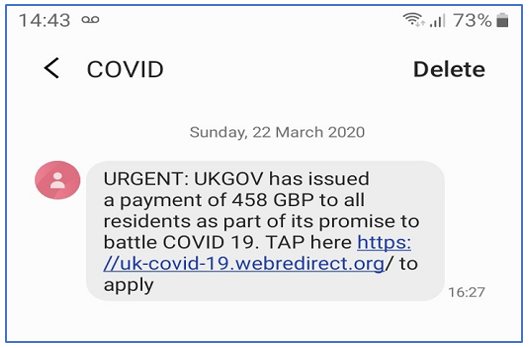

Attacks using text messages: Many people spend a lot of time scrutinizing emails but click a link in a text without a second thought. Hackers know this, and getting into your phone can be just as destructive (in terms of password and email access, among other things) as hacking your computer. A recent SMS text circulated in England caught many unsuspecting people off guard, using the strategies of urgency and (of course) free money as bait:

It is not hard to make cybersecurity mistakes. In late March, Boris Johnson posted a photo of a virtual cabinet meeting with the Zoom meeting ID number clearly visible, as well as the usernames of some ministers taking part. Critics roundly criticized his naiveté (with that information, hackers could run password algorithms to possibly gain access), and the lesson is one for all of us. When it comes to cybersecurity, you simply cannot be too careful.

* * *

Market Observations

For the first time since the Depression, advanced areas such as the United States, Europe and Japan as well as developing nations in Africa, Asia and Latin America are simultaneously mired in recession, according to a recent note by Gita Gopinath, the IMF’s chief economist. As such, we will limit our market observations since there is no shortage of data points to illustrate just how challenging the investing environment is across the globe. However, a few first and second-order effects of the current crisis are worth mentioning:

The Unemployment Crisis: About 4.4 million more Americans filed for unemployment in the week ending April 18th, leading to a staggering total of over 26 million job losses over the past five weeks. As Torsten Slok, the chief economist at Deutsche Bank Securities, wrote recently, the country had seen “a decade of job gains undone in just four weeks”:

Source: Deutsche Bank

On April 19th, The Atlantic published a troubling viewpoint suggesting that the unemployment crisis may have two distinct phases. In the first phase, the country will largely respond with a sense of solidarity and compassion for the millions who have lost their jobs, extending benefits and social welfare. However, in the second phase, once firms start rehiring following the crisis, the authors predict that “some long-running market trends toward industry consolidation (which reduces one’s choice of potential employers) [and] automation” will accelerate. Many of those now laid off may remain unemployed for a prolonged period, and companies will hesitate to hire back older and more experienced workers. Small retail stores will also struggle to re-open. In this way, we believe that this crisis will have follow-on effects that cannot even be imagined at the present.

State and local governments under pressure: The coronavirus crisis has caused states and local governments to bleed cash in order to prop up medical systems and pay unemployment claims at the same time their revenues plummet. With people forced to stay at home, sales tax revenues are way down. Layoffs will cause income tax to fall as well. Added to all of that, tax payments have been delayed until July. The Washington Post reported on April 14th that more than 1,100 cities are preparing to scale back public services, with almost 600 cities predicting they may have to lay off some government workers amid the crunch. The federal government is trying to put a package together to alleviate some of these financial pressures, but no amount of stimulus can offset the enormous challenges faced at the local government level.

Credit Downgrades and Defaults: The Wall Street Journal reported in early April that the pace of downgrades over the last two weeks of March was the fastest on record for the BofAML U.S. Corporate Index going back to 2002, according to BofA Global Research. The index saw $569 billion in downgrades since March 16th. Consumer loans are facing similar pressure as corporates. According to data provided by New York City fintech firm, Dv01, loan delinquencies are already a serious matter for online lenders:

Source: Forbes, April 16, 2020

As this graph illustrates, after the coronavirus crisis hit, late payments doubled from March 18th to April 9th. The coming credit pressures can be likened to a tidal wave: we know they are coming and they will be severe, we just do not know how far they will reach.

“Negative” Oil Prices: The New York Times put it nicely when they reported on April 21st that “[t]he coronavirus pandemic has caused a series of mind-bending distortions across world financial markets, but Monday featured the most bizarre one yet: The benchmark price for crude oil in the United States fell to negative $37.63.”

This means that oil producers were paying customers to take the commodity off their hands over fears that storage capacity could run out in May. With demand plummeting, the current crisis has caused an enormous deflationary shock to the economy. “This is off-the-charts wacky,” said Stewart Glickman, an energy equity analyst at CFRA Research told the BBC News. “The demand shock was so massive that it's overwhelmed anything that people could have expected.”

Closing Thought

“Never in the field of human conflict was so much owed by so many to so few.”

According to a report in The Guardian on April 20th, at least 50 doctors, nurses, midwives, porters and other NHS staff in the UK have died from COVID-19. In Italy, 66 responding medical workers have died according to a Newsweek report in early April. That number is assuredly higher now. In the U.S., the fatality rate of medical staff is not known. However, the number of healthcare workers who have tested positive is probably far higher than a recently reported tally of 9,200. Officials say they have no comprehensive way to count those who lose their lives trying to save others. The widespread lack of personal protective equipment, which would suggest some of these deaths could have been avoided, makes these grim statistics even more painful.

We can agree that there is no greater sacrifice than to lay down one’s life for another. In this crisis, we share the enormous gratitude for those putting their lives at stake to treat and save others infected with this highly transmissible disease. Times like these bring out the best in people, and the acts of bravery by medical professionals around the globe reaffirm in us a great confidence in the power of the human spirit.

We welcome any questions or thoughts you may have.

Sincerely,

Alternative Investment Management, LLC (AIM13)