AIM13 Commentary - 2020 Q2

“Two things are infinite: the universe and human stupidity. And I’m not sure about the universe.”

We hope this letter finds you safe and well. As we all have watched the pandemic evolve from the spontaneous crisis that gripped a few “epicenters” in March and April, now it seems that no corner of the country is being spared. We face an upcoming winter that the CDC Director recently warned is “probably going to be one of the most difficult times that we have experienced in American public health.” Regrettably, opportunities to contain the disease have been missed, and we are disappointed with the people whose risk/reward decisions have made the severity of the pandemic worse than it needs to be. Our hearts go out to those who have suffered as a result of this terrible disease.

As readers of our letters know, we are constantly trying to learn new things, and from this crisis in particular, we believe we can draw some important lessons. One of the most important lessons for us is that while people may hold opinions or predictions about the future, in order to be successful, you need to be able to admit that you do not know something or what the future holds. The “real story” is elusive, and the things we do not know – the “unknown unknowns” – are by their very nature the most difficult inputs to include in one’s decision-making. We have listened to many people who are certain about how the virus will play out and, what the long-term impact will be on the markets and society more broadly. While there are many viewpoints, we always need to evaluate the factors involved in each scenario and then determine the likelihood of that particular scenario playing out. For example, we are large proponents of getting students back into schools (for many reasons). Considering how difficult it is for students (especially younger ones) to maintain discipline in keeping their masks on, washing their hands, and social distancing (most parents understand this difficulty whether it is a young child or even, maybe a teenager), we have a difficult time laying out a scenario where this will be possible for an extended period of time as it would entail keeping infection outbreaks from schools and classrooms. The known facts are that children can contract the virus, they can transmit it, and they are more likely to not show symptoms. This leads to a highly likely scenario of children possibly spreading the virus to not only fellow students and teachers but also to their families. An unknown is the long-term effect of the virus on children’s health. Unfortunately, there is not enough data or time to know either way. As a result, parents essentially need to assess the probability and potential severity of a negative outcome and then weigh them against the costs of not sending students back to the classroom. There is no “correct answer” and individuals need to evaluate the risk/reward but should not ignore what the facts are, what we likely know to be true and what we do not know for certain.

We have been accused of always being “negative”, “focused on the fear side while ignoring the hope side of the discussion” and a few people have even called us ridiculous and “doomsayers” (that was in regards to us for many years having “go bags”, N95 masks, defibrillators, etc. in our office and homes). We have always stuck to our beliefs that being prepared for what could happen allows us to NOT panic when something does happen. As we have stated, acting out of fear is not prudent, but neither is acting out of hope. In our everyday lives and in investing, we work to determine what could possibly go wrong and how we can easily prepare for it, which then minimizes the panic and the downside when something does happen.

Once something happens (whether it was the early 1990’s recession, the 1998 Russian financial crisis, the DotCom crash, 9/11, the 2003 blackout in the Eastern half of the United States, the Great Financial Crisis, the flash crash, etc.), we want to be in a position to stay as calm as possible, analyze the facts and consider the things we do not know for sure by placing probabilities on them happening, which then allows us to act more prudently. We constantly remind ourselves that things do evolve, information in the information age moves quickly so we work to remain nimble and not anchored to any idea or belief. We do realize no one can prepare for everything, but by taking the time and putting effort into analyzing what is possible before things do happen, allows us to make better decisions during the chaos and most importantly, whether it be with the virus or investments, minimizing (again - it is impossible to eliminate) the unknown risks increases the probability of us achieving a successful outcome.

While the second quarter was the best quarter for the S&P 500 TR since 1998, the current spread in performance among the widely followed equity indices in the U.S. tells us a more nuanced view of the markets is warranted:

As we discuss more below in our Market Observations, this spread among the indices parallels the spread in performance among the constituent companies – i.e., a small handful of stocks are driving returns, which we think has some important implications for investors today.

* * *

“Son, your ego is writing checks your body can’t cash.”

There is an enormous amount of information about this pandemic, however it can be misleading, and so-called “facts” often change. Moreover, on the Internet you can find almost any information to reinforce your perspective or bias, and marshal support for whatever argument you endorse. To be truly analytical, however, you must analyze the biases and the quality of the information, and you must remove ego and emotion. Moreover, to reduce the risk of finding yourself in your own “echo chamber” (which is easy to do on the Internet), it is important to read things you may disagree with and to challenge yourself to figure out your own “unknown unknowns.”

For instance, we have often heard (and we like to think) that there is no long-term medical impact from COVID-19 for someone who is medically healthy. However, the fact is that we do not know since we have not been able to study the long-term effects. Indeed, according to the South China Morning Post, the first known case of the disease was reportedly identified only on November 15, 2019, about nine months ago. While we hope there are no long-term effects, we believe the consequences of not being prudent about the disease are too great relative to the “rewards” of being cavalier.

The same can be said about investing today. We think there are indeed many opportunities, but in our conversations with other investors, it seems that people are overestimating their ability to understand what is going on, relying on emotion and ego, and ignoring the magnitude of the risks we face. Putting it bluntly, we feel many investors are being arrogant by letting their biases get in the way and refusing to listen to any point that does not align with their belief. Investors who are successful over the long-term are able to remove (or reduce) emotion and biases, analyze the credibility of the information they are absorbing and most importantly stay calm and maintain a long-term view. Very rarely is that information definitive. However, the best investors can take a step back and understand (a) what they know for certain, (b) what they think they may know, and (c) what they do not know – and they are able to make decisions knowing there are things that they do not know. We all need to take risks in order to generate returns but if we do not know what the risks are and what we do not know, it is impossible to make good risk/reward decisions.

“Education is not the learning of facts, but training of the mind to think.”

We were reminded of this quote when we recently read about the Dunning-Kruger effect. In the late 1990’s, Psychologists David Dunning and Justin Kruger gave a test to a large group of students and asked each one to estimate his or her overall score and their relative rank among their peers. Students who scored the lowest in these cognitive tasks always overestimated how well they did. Not only were those students less competent, they lacked awareness of just how bad they were. Known as “illusory superiority,” low-ability people do not possess the skills needed to recognize their own incompetence or lack of knowledge. Students who scored the highest had more accurate perceptions of their abilities, but they underestimated their relative performance. The test was easy for them, and they assumed it was easy for everyone.

According to the author Robin Powell, who writes for The Evidence-Based Investor, approximately 88% of investors assume they are better relative to their peers. With the S&P 500 TR a little more than flat for the year as of this writing, many investors feel overly confident, if not arrogant, about their portfolios and the prospects for positive returns. What is worse, people who take risk tend to take more risk every time they “get away with it.” We have not shown this photo in a few years, but it seems right for today:

“Just because you got away with it doesn’t mean you didn’t take any risk…”

People need to understand risk. When it comes to COVID-19, unfortunately, we cannot live “risk-free” and completely ensure that we avoid the virus. Even in the cocoon of one’s own home, we have seen cases of people contracting the disease without any apparent contact with infected people. However, what is an “acceptable risk”? Going out to dinner with people after being exposed to someone who might have the virus is simply not a smart risk since it is also risking other people’s health. Sitting outside with someone close by without a mask for an extended time also is taking a risk. In this regard, the problem with this disease is that the risk analysis has two dimensions: the risk that you get it yourself and the risk that you expose someone else. Sadly, many people are not being smart about either risk.

Likewise, we think ignoring all the bad news out there and the potential for a continued slowdown in the economy to us is not a smart risk. Investors are currently sitting on enormous piles of cash. According to a report in the Wall Street Journal in June, assets in money-market funds recently stood at about $4.6 trillion, the highest level on record, according to data from Refinitiv Lipper going back to 1992. However, as investors look to deploy that capital, both in the short term and the long term, we believe the future has a lot of potential risks. There are currently about 30 million Americans getting unemployment benefits. According to research by Deutsche Bank, before the virus, the nationwide average weekly unemployment benefit was $400. The CARES act has added an extra $600 weekly payment. However, this added benefit ended on July 31st. Regardless of how Congress resolves the current impasse on stimulus, as we see it, there is an enormous risk that we could see a decline in consumer spending and in households’ ability to pay their credit cards, auto loans, rent, and mortgages. That is just one risk among many. How will investors react to another period of volatility like we saw in March?

“If investors weren’t people, common stocks investment would be a 100% sound proposition. Unfortunately, investors are people, and they have a great tendency to do the wrong thing when they enter the field of common stocks.”

Risk is a necessary part of life, and investors cannot generate returns without taking risk. However, putting all your money on red or black might work but it is a lot like sticking your head in the lion’s mouth; you may get away with it four or five times, but the sixth time can be quite painful. We spend a lot of time working to understand risk and talking to others, trying to constantly learn and explore what we do not know. We always try to remind ourselves of the value of “you never learn anything new with your mouth open.” Having invested in the markets for decades, we have an overall portfolio that we feel has an acceptable level of risk for us, and a hedged portion is an important part of that.

“Difficulties are just things to overcome, after all.”

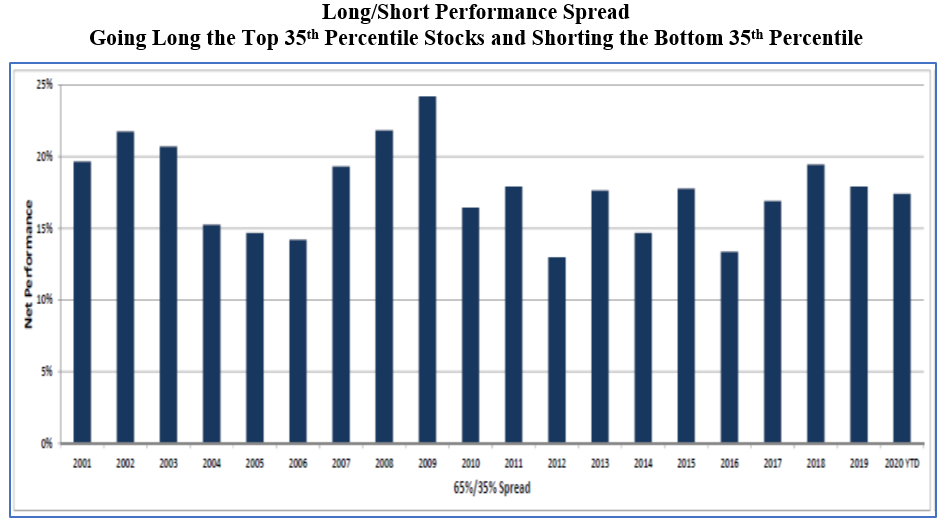

We are not advocating doing nothing or hiding under your bed. Pointing out the risks we see does not mean we want to live in a bubble. While the current environment presents many risks, there are also enormous opportunities for investors who can do deep due diligence on companies and separate the wheat from the chaff. However, we also know our limits, and we know that there are smart people who can do that far better than we ever could. For this reason, we think now is one of the best times to have a portion of one’s portfolio in a hedged strategy. In the markets today, you do not need to pick the top decile stocks, or even the top quartile stocks, and similarly short only the very worst companies, to generate superior risk adjusted returns with a long/short strategy. As shown below, simply going long the top 35th percentile stocks and shorting the bottom 35th percentile stocks can generate mid-teen returns:

Source: Novus (January 1, 2001 – June 30, 2020). Representative of the iShares S&P 500 Index returns.

In summary, we are very bullish on the future and think that advances in technology will continue to be a major tailwind for the economy and the markets. However, we are also cautious and aware that there may be a lot of road bumps on the way, those we can see coming and those we cannot. Our downside is the permanent loss of capital, and therefore, when we use managers who take higher levels of risk, we size them proportionately. As we look ahead to AIM13’s third decade, we continue to play the long game and to strive to be patient and invest with managers who have aligned interest with their partners and do not chase a quick dollar. We believe this has served us well, and will continue to do so into the future.

* * *

Due Diligence Tip: Hackers Targeting Alternative Asset Managers

We regularly talk about cyber threats in this space and at the risk of banging the same drum, we wanted to again call attention to the unique risks associated with firms providing financial services beyond traditional banking and credit. In April, the FBI's Cyber Division reported a 300% to 400% increase in daily complaints at its Internet Crime Complaint Center, according to an article published in The Hill. Moreover, according to a recent report on Business Insider, cyberattacks against financial firms are up 238% this year. The pandemic has created enormous opportunities for hackers around the globe.

Hedge fund and private equity firms present unique risks for investors when it comes to cybersecurity. Since most alternative asset managers are privately held, and therefore do not have the public company reporting obligations that would require disclosure of a cyber incident, we believe attacks on these firms are far more prevalent than what is reported. No manager wants to make public that they paid a ransom or their IT systems were comprised. Alternative asset managers also often outsource the IT and cybersecurity functions, and spending in this area varies greatly among firms. In addition, hackers view the firms as deep-pocketed and therefore have the resources readily available to pay a ransom. Finally, these firms are known to have wealthy individual investors, so a hacker can both infiltrate the firm itself and at the same time possibly hack through to its ultra high net worth investors as well.

For these reasons, we include a cybersecurity assessment as a part of our initial operational due diligence of a manager and revisit that assessment every year during our operational due diligence reviews. We always ask the question, have you been hacked? Some of the other things we look at include:

Critical infrastructure and operational resiliency

Perimeter security

Vulnerability scanning and patch management

Preparations for incident response

Access management and endpoint security

Awareness and training

As the hackers become more sophisticated, we must re-double our efforts to ensure that our capital and that of our partners invested alongside us remains secure. Connectivity to a private cloud helps, as do firewalls with redundancies, strong web and email filters, recurring third-party penetration testing, among other things. However, a firm’s weakest link is its people. According to CSO, 94% of malware is delivered via email, and phishing attacks account for more than 80% of reported security incidents. Training employees not to open suspicious emails is the single best way to reduce the risk of an attack, and we scrutinize our managers to ensure the importance of cyber-security is foremost on every employee’s mind. At AIM13, we conduct periodic campaigns where we attempt to test our team’s diligence and cyber awareness with spoofed and targeted emails “enticing” users to click. The phishing emails and threats continue to grow, as the working from home environment provides more opportunities for employees to “click” malicious emails.

While there seems to be an increased focus on cybersecurity today, it is worth noting that the vulnerability of our IT infrastructure to attacks has been around since the dawn of the PC and the use of the Internet. We have this TIME cover from September 26, 1988, over thirty years ago, framed in our conference room to remind us that the importance of cybersecurity is nothing new:

To us, cyber risk is another example of something that for many years was an “unknown unknown.” Like the coronavirus now wreaking havoc around the world, a cyber meltdown could be even more catastrophic, and we must never let our guard down for even a single day, individually and as a firm. For that reason, we have included our piece on “The Importance of Freezing Your Credit” to remind everyone that taking this simple step can be an important way to fend off the cyber criminals.

* * *

Market Observations

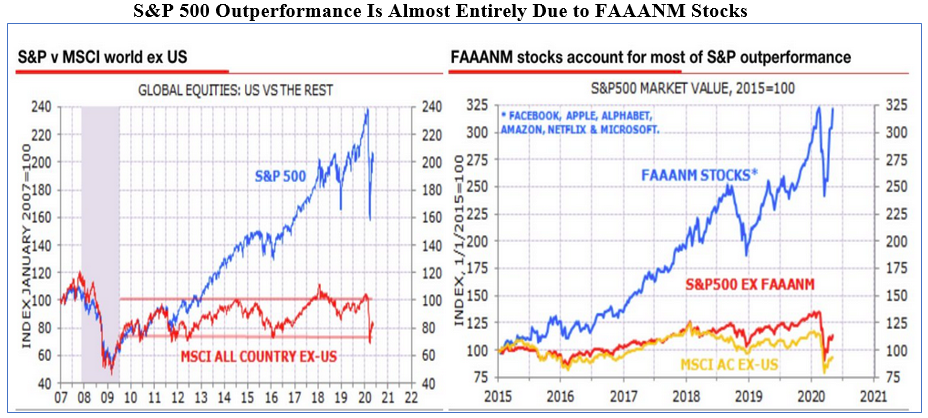

It seems everything is getting more polarized these days, and the performance of U.S. stocks is no exception. This quarter we take a look at the growing spread between a handful of large tech stocks versus the broader market and what that may mean for investors today. According to research recently published in Seeking Alpha, five stocks - Microsoft, Apple, Amazon, Facebook and Google - now account for about 21.7% of the S&P 500 Index. At the peak of the tech bubble, the top five stocks in the S&P 500 only reached 18% of the index. Indeed, according to Bridgewater Associates, the market cap of those five companies is greater than every listed index outside the US and Europe. Moreover, as CNBC reported in July, when Tesla (arguably another tech stock) is combined with the big five tech companies, the group made up a stunning 49% of the Nasdaq 100.

In the second quarter, tech stocks continued to gain as investors sought out companies that enabled shopping, remote working, and other pandemic-driven activities. In fact, when you look at the sectors of the economy that are doing well in the first half of the year, it is no wonder Big Tech is far outperforming other stocks and sectors:

Source: Bridgewater Associates, Daily Observations, August 6, 2020

As the performance of these stocks outpaces the rest the market by a wide margin, so too do their weightings:

What does this mean for investors? First, these trends illustrate the increased concentration risk in broader indices (like the S&P 500) that are widely thought to be diversified. Truth is, they are not. A stumble by even just one of the biggest players will have an outsized effect on the overall market. (For instance, what if there was an accounting scandal at a firm like Apple? That inevitably would pull down Microsoft and perhaps the others, causing a fast correction in the S&P 500.) A shock to one could quickly lead to a significant market pull back, and we have seen how quickly the market can move against investors.

Likewise, the component companies of the indices are not doing as well as the overall market return might lead you to believe. The chart below shows just how much the S&P 500 return recently has been driven by just a few stocks:

Source: Zerohedge and Gerard Minack, Downunder Daily

Indeed, without the big tech stocks, investors in the Wilshire 5000 have had almost no return since January 2018:

Another aspect of the rise of the tech giants is increased regulatory scrutiny. During the anti-trust hearings with the CEOs of the major tech companies in late July, one lawmaker had this to say:

“[T]hese companies as they exist today have monopoly power. Some need to be broken up… Their control of the marketplace allows them to do whatever it takes to crush independent businesses and expand their own power. This must end.”

- Congressman David Cicilline, July 29, 2020

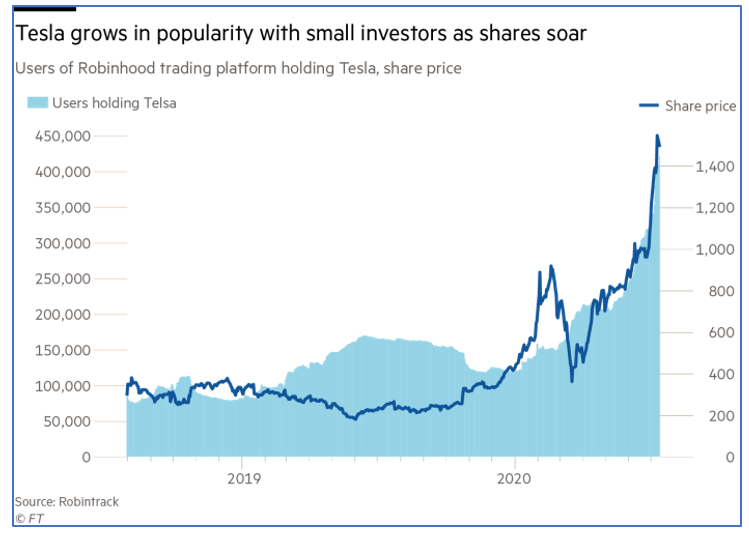

A dynamic related to enormous growth of big tech is playing out with Tesla’s stock. Tesla’s intraday price per share topped $1,790 in July, putting the automaker at a market capitalization greater than any car maker on the planet. To put that in perspective, note that Tesla only sold about 360,000 cars last year, compared to nearly 11 million by each of Toyota and Volkswagen. Beyond the sky-high valuation, what is troubling is who may be buying the stock. The chart below shows that the number of account holders on the Robinhood trading platform (a low commission service targeting small investors) owning Tesla stock has almost tripled since the beginning of the year:

Source: Financial Times

We believe that the heightened risk profile for the market (because of the concentration) combined with the underlying dynamic of the large majority of companies not doing well, along with the presence of retail investors driving up market values for companies like Tesla, all suggest that investors should be much more cautious than they are.

Closing Thought

China is a major risk to our economy, and it is not an overstatement to consider that we are essentially at war with their government. There are almost daily reports of Chinese aggression. In July alone, a Chinese scientist suspected of visa fraud and concealing ties to the Chinese military took refuge in the country’s consulate in San Francisco. She was later arrested by the FBI. Separately, the Justice Department accused two Chinese hackers of “targeting vaccine development on behalf of the country’s intelligence service as part of a broader years long campaign of global cybertheft aimed at industries such as defense contractors, high-end manufacturing and solar energy companies,” according to a report in the New York Times. In a recent speech, FBI Director Chris Wray said the FBI is opening a new counterintelligence investigation involving China every ten hours. Wray added, “There’s no country that presents a broader, more comprehensive threat to America’s innovation, to our economic security, and to our democratic ideas than China does.”

Unlike most of the developed world, the Chinese government works hand in glove with private companies in China. Our government cannot play the same game. That is not to say the Western world has never engaged in corporate espionage. According to the Smithsonian Magazine, in 1848, the British East India Company sent Robert Fortune on a journey to China to steal the secrets of tea cultivation and manufacturing: “The Scotsman donned a disguise and headed into the Wu Si Shan hills in a bold act of corporate espionage.” Unfortunately, today there is a lot more at stake than the horticulture of tea.

We welcome any questions or thoughts you may have. Please stay safe and well.

Alternative Investment Management, LLC (AIM13)