AIM13 Commentary - 2022 Q2

“We confuse activity with progress, and that’s always dangerous, especially in war.”

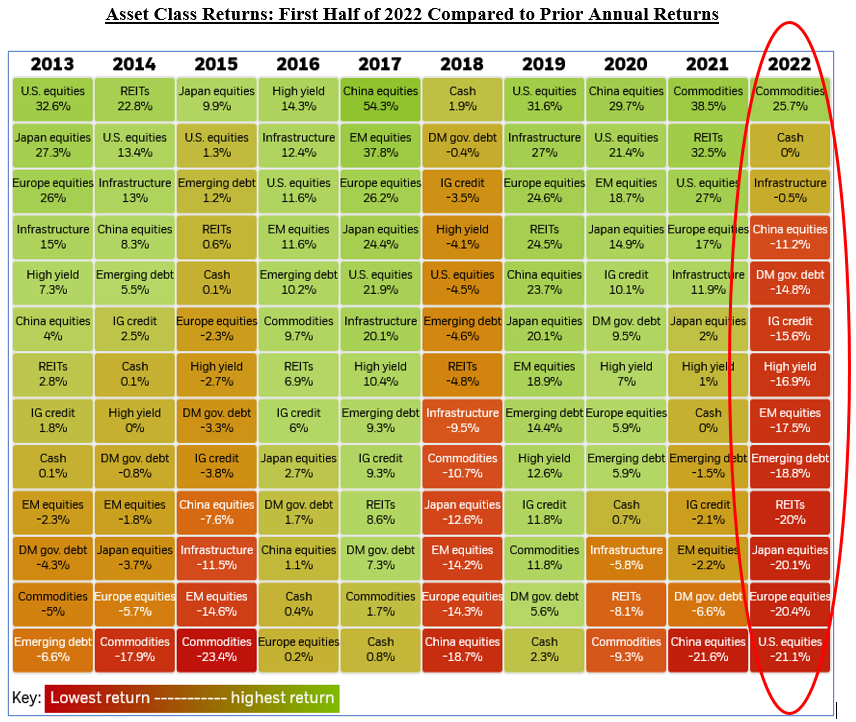

In the first six months of 2022, most investors have felt that there has been no place to hide. With the exception of commodities (whose strong returns are almost entirely driven by the Ukraine war), the breadth and depth of negative returns across asset classes is the worst we have seen in decades. Indeed, the S&P 500 Total Return (“S&P 500 TR”) had its worst first half since 1970 and fourth worst in history. In mid-June, the index was down 10 of the prior 11 weeks, which Bloomberg reported was the worst stretch since the Depression. U.S. Treasuries fell 11% through June, the worse year’s start since 1973, as reported by Reuters. In fact, a 60/40 portfolio of stocks and bonds, which is viewed as a balanced portfolio, was down (16.9%) this year through June 30, based on Morningstar data. It has been very tough this year, but the problem we see is that people are panicking, making changes to their portfolios just to make changes, and taking action based on what has happened in the past rather than on what will happen in the future.

“What you did was impulsive, capricious, and melodramatic, but it was also wrong.”

We find that during difficult times many people drive using their rear-view mirrors and let emotions take over. For example, a recent Allianz study found that 65% of investors were keeping money out of the market for fear of investment losses. We also find that not only do people tend to make the wrong moves in challenging markets, their recollection in retrospect of how they responded at the time does not always line up with reality, as we have tried to illustrate before with this cartoon:

We work hard every day – and especially during volatile times – to keep emotions out of our decision-making process when we consider where to go from here. We realize that we were wrong in not believing the bull market that started in March 2009 would last as long as it did. Moreover, we do not fully understand this current, nine-week rally. However, we will not panic and abandon our hedged strategy.

If one believes that all of our problems are behind us, we would encourage them to simply buy ETFs and lever them up. For us, we think that maintaining a portion of our overall portfolio in a hedged strategy makes the most sense. The uncertainty about our economy has created a very difficult investing environment during the first half of the year (as shown in the chart below), and we remain convinced that the next decade will not be identical to the past decade.

Source: Blackrock, as of July 1, 2022

Beyond strict asset class returns, some other economic indicators in the quarter that we are concerned about include:

Inflation hit 9.1% in July, its highest since November 1981. Even though the recent inflation number in August eased a bit to 8.5%, that is still a major burden on consumers and businesses.

Dollar-Euro exchange hit parity, the first time in about twenty years and adding pressure to a European economy already stressed by steep reductions in natural gas supply from Russia.

The Federal Reserve continues to signal rising rates, making this the first time we have had a hawkish Fed during a bear market since the early 1980’s under Paul Volcker.

The IPO market is almost frozen: 1,073 companies went public in 2021, but only 92 did so during the first six months of 2022, which if continued represents an 83% drop year-over-year.

Consumer sentiment reaches new lows: In June, the University of Michigan’s survey of consumer confidence hit its lowest level in its 70-year history.

Cryptocurrencies have dropped nearly 60%, with several exchanges going into liquidation, wiping out over $2 trillion since the peak in November 2021.

Copper. Viewed as a measure of sentiment about the global economy, copper is down more than 20% since January, hitting a 17-month low on July 1, according to the New York Times.

“You trade and invest in the markets you have, not the ones you want..”

While we share the frustration of investors, when it comes to portfolio management, we believe frustration cannot be a driver of change. Our core principle of partnering with smart managers who have most of their net worth invested alongside us remains fundamental to our investment strategy for this portion of our overall portfolio. The key is to find the balance between taking action and panicking. Too many people confuse activity with productivity. Even professional investors are dramatically repositioning their portfolios in reaction to current challenges. According to a recent report in the Financial Times based on a Bank of America Survey, large fund managers reduced their net overweight position in stocks in July to the lowest level since October 2008, while also boosting cash holdings to a 21-year high of 6.1%. Ironically, in July, the S&P 500 TR had one of its strongest months ever, once again demonstrating the folly of trying to time the market.

“The underlying driving force behind market timing decisions seems to be emotional – fear, greed, chasing performance – buying something after it has gone up, disappointment, and sales after something has declined.”

Many investors make decisions to time the market, thinking an up day or several up days signal a market turn. Attempts at market timing, however, have been shown to fail over the long term. A recent report by JP Morgan found that the ten best days over the past twenty years occurred during bear markets – amid the 2008 financial crisis and the 2020 pullback at the onset of the pandemic. Misreading these days as market inflection points and reacting impulsively is a huge mistake.

With most hedge funds down this year, many investors are asking, is now the time to give up on the strategy? We think not for several reasons. First, hedge funds have demonstrated outperformance in down markets. With the current market teetering on the brink of recession (or arguably already in recession), the risk of permanent capital loss in the coming months is as high as it has been in our investing careers. As the chart below illustrates, with the exception of September-November 1998, hedge funds (as represented by the broad-based HFRI Index) have materially outperformed global equities during drawdown periods over the last several decades:

Source: UBS, using Bloomberg data (June 2022)

We also think that hedge funds will benefit from the current rising rate environment. Higher interest rates also mean the end of “free money,” and we believe that means that company stock performance will be more correlated with fundamentals going forward. That bodes well for active managers who do fundamental research since security selection will mean more. In other words, to borrow from Warren Buffett, the rising tide of low rates that lifted all companies as it came in will, when it goes out, show us which have been swimming naked.

Due Diligence Tip: Lying on Wall Street

“Well of course they’re trying to screw you!

What do you think? That’s what they do.”

The first question we ask ourselves when a manager tells us about a change in terms or new opportunity that sounds too good to be true is, how am I getting screwed? Maybe we are cynical, but this instinct comes from years of observing some investment managers put their interests before their investors. It is all too common, and when we came across this anonymous observation recently, we were not shocked:

“The ease with which my fund’s CIO lies to our investors is frightening. Not about returns or anything like that, but about pretty meaningful things nevertheless. And even worse, it really

seems like being able to casually fib like that is a trait that leads to success in this industry.”

Just this week, our friend, Doug Kass, wrote about the importance of speaking the truth. As investors investing our own capital and those of our partners who invest alongside us, we must be especially vigilant. The line between the truth and make-believe is not always clear. Benn Eifert, the managing partner of QVR Advisors, put it this way recently: “Bullshit in investing, be it wild over-optimism, deception or fraud, is as old as time, precisely because it is hard to resist the promise of easy returns and to tell the difference between innovation and make-believe.” Click here to read the full article.

“Past performance is not necessarily indicative of future returns –

unless you are talking about someone’s character.”

How do we manage this dynamic? Our investment process is more than just “trust, but verify.” We focus on the character of a manager because any fault lines in one’s character – be it bad behavior in college or even a low Uber score – almost always signal an unwillingness to stay true and follow their process in difficult times. We also triangulate different data pools, looking at independent inputs for even minor discrepancies that can lead to more serious operational issues (or worse). We also consider past bumps in the road that every manager encounters and consider when something did not go as planned, did the manager own the mistake or make excuses and blame others?

Market Observations

Rising Inflation and the End of the $1 Soft Drink

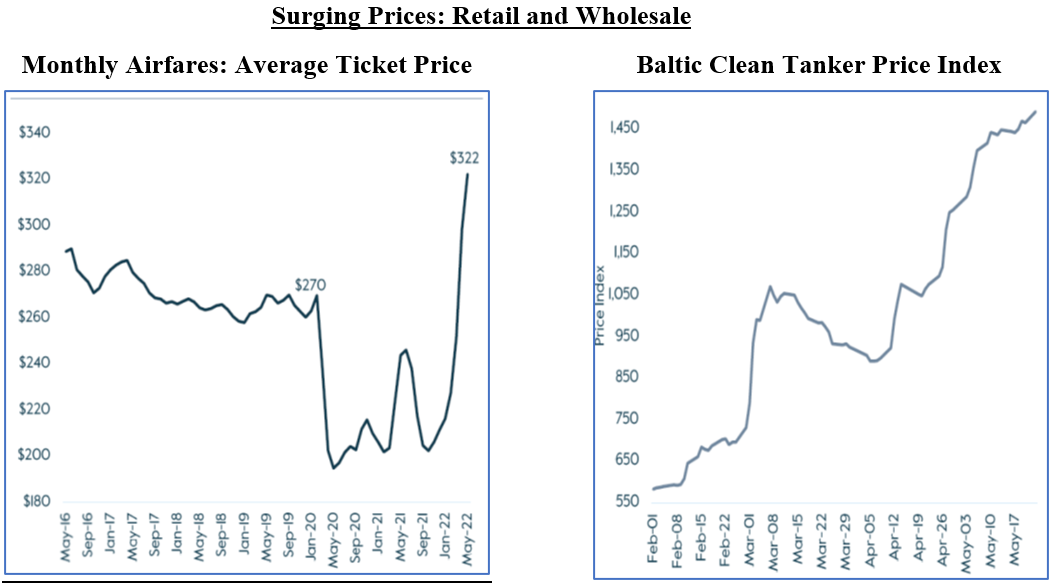

The largest consumer companies in the U.S. are seeing the effects of rising prices on the ordinary consumer, as reported by Business Insider in late July. A growing number of McDonald’s franchises are eliminating the $1 soft drink. Walmart reported on July 25th that many shoppers can no longer afford anything but basic groceries. AT&T customers are paying their bills later than usual, and Best Buy has seen a big fall in demand for electronics. The spike in prices both at the retail and wholesale levels has been staggering:

Source: Carlyle, May 2022 (using Bloomberg and Census data)

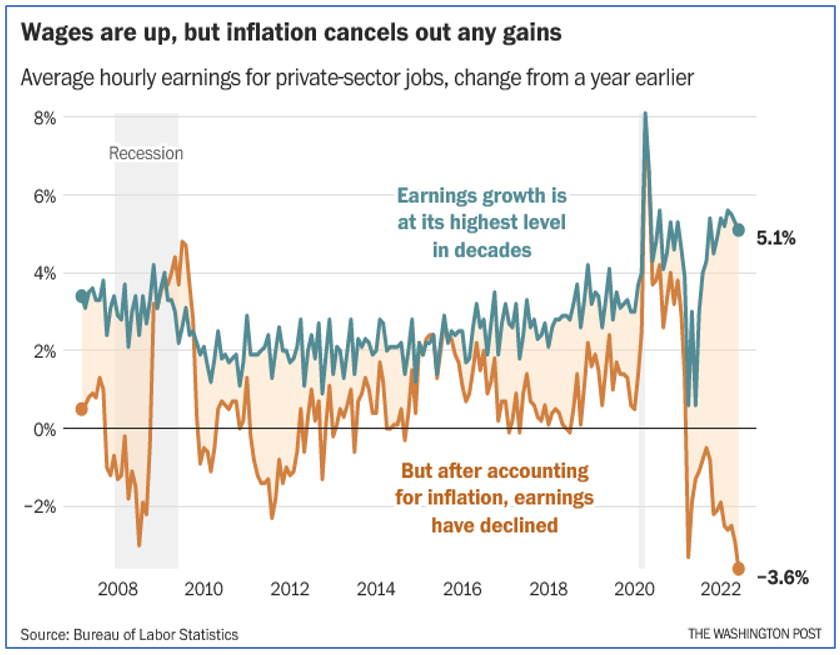

Many people say that inflation has peaked, especially given the August report. However, even if we already have peak inflation, we are still a long way from 2% inflation. That means the average consumer will not be getting a break in price hikes anytime soon. We frequently read about workers working two jobs and even wanting to be paid daily – just to pay for gas and food. This is not surprising since the real wage declines are worse today than they were in the Great Financial Crisis:

Source: The Washington Post, July 17, 2022 (using Bureau of Labor Statistics data)

A Lack of Discipline in Private Equity

In recent years, just as retail investors chased returns in public markets, many GP’s and investors in private equity, especially in the large and meg-cap space, pushed up companies to outrageous valuations and now face deep mark downs in their portfolios. Klarna, the Swedish “buy now, pay later” lender that was valued at $45.6 billion just over a year ago, saw its valuation slashed by 85% in the latest down round in July. The company had been touted by big pension funds like Skandia Mutual Life as recently as April.

Not only are marks coming down, with rates rising, the pace of exits will also slow, as Bain & Company noted in its half year report: “Due to the bulk of sponsor returns coming from multiple expansion, the rising interest rate environment could see exit activity reduce further as multiples flatten and as sponsors hold assets long until return targets are met.” Global buyout-backed exit value hit $338 billion in the first six months of the year, down 37% from the same period last year, according a recent report in Private Equity International. We believe all of the follow-on effects of these dynamics are not yet fully seen.

Leveraged Loans: This Cycle’s Ticking Time Bomb?

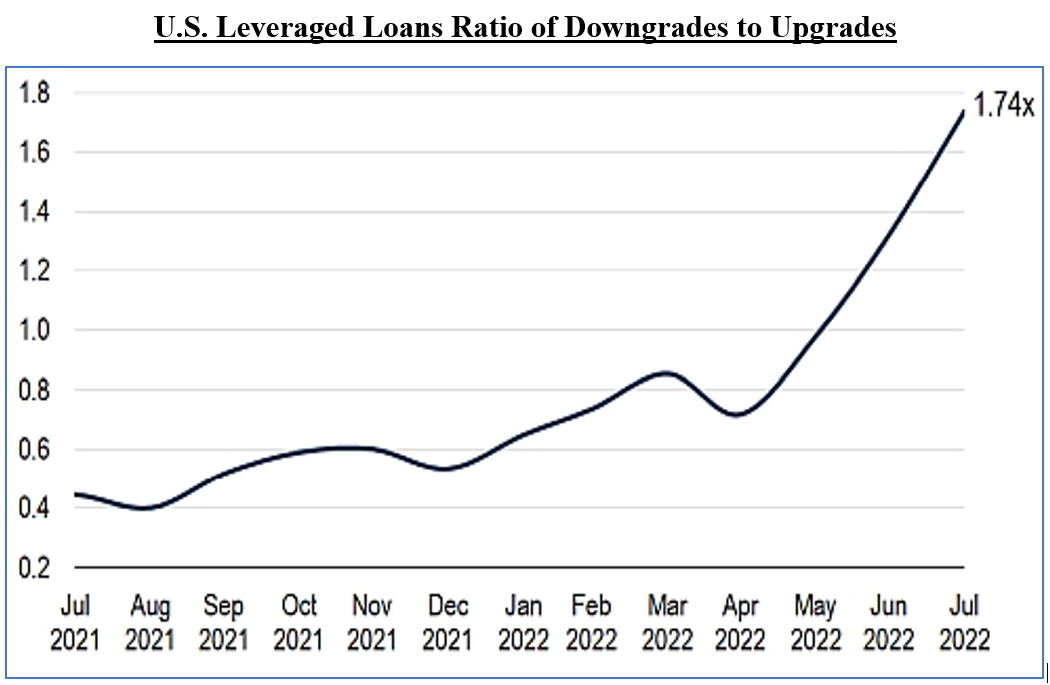

According to Michael Anderson, an analyst at Citigroup Inc., the average discount on loans sold in June reflects the biggest discount in a decade, with prices averaging 95.5 cents on the dollar. At the same time, in the first quarter of 2022 leveraged loan issuance in the U.S. was the weakest since the first quarter of 2015, according to a report on Bloomberg. With returns lagging, it is not surprising investors are extremely cautious about the space.

Source: Wall Street Journal, July 16, 2022 (based on S&P data)

As the Fed continues to tighten money supply amid inflationary pressure, concerns of a recession have caused an uptick in the volume of performing loans priced below 80 — typically considered a forward-looking measure of potential future defaults. The data on downgrades corroborate this:

Source: S&P Global based on Leveraged & Commentary Data; data is rolling 3 months through July 31, 2022

Closing Thought: Drones in an Unsafe World

Bloomberg Businessweek, July 25, 2022

We congratulate the CIA and our armed forces for recently bringing to justice one of the most senior terrorists responsible for the attacks on September 11, 2001. The use of a sophisticated drone in the heart of Kabul, apparently avoiding any collateral damage, reinforces the value of drone technology in an unsafe world. We first mentioned drones in these letters in May 2019, and we believe drones will reshape a wide variety of industries. Verified Market Research published a report in April that forecasts a CAGR of the drone industry at approximately 16%, increasing from $19B in 2020 to over $63B in 2028. We are equally bullish and, through our partnership with Ambassador Hank Crumpton, have made investments in several companies that we think will benefit from the favorable industry dynamics. For instance, since 2019 we have been invested in WhiteFox Technologies, which provides a counter-drone solution, and earlier this year we invested in Epirus, which offers a directed energy system to counter swarming drones on the battlefield (and the system has exciting commercial potential as well). We have also shared with our managers insights and opportunities in the drone space sourced from our network with Ambassador Crumpton.

We welcome any questions or thoughts you may have.

Alternative Investment Management, LLC (AIM13)