AIM13 Commentary - 2022 Q3

“You kids are soft. You lack discipline…You’re not going to have your mommies run behind you anymore and wipe your little tushies… No more complaining!”

Never before have we seen more investors who are tired, frustrated, and worn out by the current investing environment as it is one of the most difficult we have seen in the last forty years. However, we do not have much patience for investors who just whine about the lack of easy investment opportunities out there. We all must remind ourselves that making money is not supposed to be easy – a foreign concept to many given the thirteen-year run of largely rising markets. Successful investors do not whine or panic when things get tough. They develop a plan and execute, regardless of how difficult it is. So that is what we have been doing and will continue to do. Successful investors know that they will not be judged just because they went through a tough time; they will be judged by how they worked their way through it.

Volatility continued in the third quarter, with the S&P 500 TR down (4.08%) in August and even more steeply in September, down (9.21%) in its worst decline since the pandemic. In those two months, the market fell (12.91%). At times like these, we believe that a strategy that protects capital in rapidly falling markets will reward long-term investors.

* * *

“Complaining about a problem without proposing a solution is called whining.”

ri-ˈzil-yən(t)s

1. the capacity to recover quickly from difficulties; toughness;

2. the ability of a substance to return to its usual shape after being bent, stretched, or pressed.

- OxfordLanguages; Cambridge English Dictionary

In tough times, we often resort to the basic things that we all teach our kids, like discipline, patience, morals, and humility. Perhaps above all we think about RESILIENCE and how one will be judged when faced with adversity. Right now, everyone feels tired and worn out, and there is little good news to speak of – whether it is the economy (inflation, rising rates), domestic politics (the most sharply divided country since the Civil War?), geopolitical risk (Russia/Ukraine, Taiwan/China, Iran, nuclear “armageddon”?), etc. In fact, we cannot remember a time more bleak than this. Even at the depths of the pandemic or the midst of the financial crisis, there was a sense of a passing storm. Not so much today.

“Resilience is accepting your new reality, even if it’s less good than the one you had before.”

However, it does no good simply to whine, moan, and complain about the current investing environment. Our energy must be focused on figuring out what to do now to get through it – which we know we will do. As Dale Carnegie quipped, “Any fool can criticize, condemn, and complain… and most do.” We must dig down, work hard, and move forward.

How do we do that? We rely on our experience, process, and discipline to stay focused and work all the harder to find what other investors overlook. Above all, we must not panic. While it is tough in the markets right now, we also live in a time of great opportunities. Advances in technology are disrupting virtually every segment of everyday life. Investors who are willing to do the work necessary are finding the companies that will benefit from that trend and shorting the ones left behind. Rising interest rates are a headwind for the economy, but they also can provide a tailwind for managers who can short effectively. They also foster a more conducive environment for stock pickers. With no more free money propping up weaker companies, we think patient investors who focus on high quality companies rather than finding the next big growth story will generate superior risk-adjusted returns.

“A goal without a plan is just a wish.”

More than ever, investors need a plan, the rigor to implement it, and the discipline to see it through. We have spent a lot of time recently re-underwriting our investments. We have seen that some managers who are down become more engaged, while others throw in the towel. Our job is to identify which managers we should be bullish about from here and which we should fire and cut our losses. In addition, investors who are under the high-water mark with managers is an added “benefit” – but one no one hopes ever to have again.

Some steps we have taken include:

Finding more nimble managers. We believe managers who can navigate a very fluid macro and market environment currently are an important part of any portfolio. At this particular moment in the economic cycle, having the flexibility and the mental bandwidth to move quickly has proven to be an effective attribute.

Focusing on managers with a broader tool kit. With risk free yields returning to more historic norms, cash can be a tool that some managers have used to dampen volatility and provide some downside protection. We expect more managers to employ such portfolio management tools to protect capital in an unusually volatile market.

Increasing exposure to small and mid-cap names. While we do not tend to pivot towards a particular investment strategy at any given time, we do believe that the current environment is conducive to managers who can demonstrate an ability to find more marginalized companies overlooked by others who trade in more crowded positions.

Enhancing our manager due diligence resources. We often say that if you surround yourself with smart people, good things will happen. In that spirit, we have added several experienced investment professionals to the AIM13 team. As noted earlier this year, Phil Villhauer joined our firm as a partner. Phil has over thirty years of experience in firms such as Citadel and Point 72. Earlier this month, Karen Morris and Elizabeth Hilpman joined the team as advisors. Karen spent over twenty years on Wall Street and has since been managing portfolios of hedge funds and commodity pools. Elizabeth is a seasoned investment professional with decades of investment experience at Commonfund, Dartmouth College, GAM, and, most recently, as CIO of Barlow Partners. We think Phil, Karen, and Elizabeth bring enormous firepower and perspective to our investment team.

The bottom line is that whining is a waste of energy; one’s time is better spent doing something productive. In the midst of challenging times, as investors we need to roll up our sleeves, develop a plan, and get things done, no matter how hard it is. In other words, go home or go to work!

Due Diligence Tip: Asking the Right Questions

“Be curious, not judgmental.”

We often tell our analysts that the type of question we ask a manager is just as important as the question itself. We were reminded of this recently when we read a piece in Forbes about lessons learned from a scene in the popular television show, Ted Lasso. The brief takeaways from the article and the scene, along with how we think about questions in the context of manager meetings, can be summarized as follows:

Ask open-ended questions: A closed-ended question has a limited number of responses (at a minimum, the yes/no answer) and often acts to narrow a discussion rather than expand it. Although they can be necessary, in due diligence we have found that it is more effective to start broad with questions that require expansive answers, such as “What do we need to know about the portfolio?” Other more provocative questions at the end of the meeting include, “What are smart investors asking you that we haven’t?” and “If you were in our seat, what is the question that you would have asked that we haven’t?”

Use the “power pyramid” of questions: First defined in an essay entitled “The Art of Powerful Questions” by Vogt, Brown, and Isaacs, the basic hierarchy of responses in any Q&A goes from yes/no to who/when/where to what to how and finally to why. The purpose of a manager meeting should be to focus on the top of this pyramid and not just to “report the facts.” Understanding what motivates a manager and what drives his or her decision-making is critical to assessing how the manager may perform in the future.

Never assume you know the answer: Sometimes an analyst will do a call or a meeting and fail to confirm the most basic information or be sure about something critical that came up because they “didn’t want to ask a dumb question.” Assuming that something is the case or avoiding the risk of embarrassing yourself by asking the question is one of the quickest ways to get something wrong. As we never shy away from a cliché, we like to remind our analysts that those who just assume make an ASS-U-ME!

Sometimes we feel like the toddler who keeps asking “why?” in manager due diligence meetings but we have found that getting to the “real answer” takes persistence and patience. Some of the biggest mistakes in selecting managers can be avoided by imitating a doctor who continuously probes, asking “Does this hurt?” and “Does that hurt?” until they find the pain point.

Market Observations

There has been no shortage of scary headlines this year:

Yet just two weeks later, the news can change dramatically:

* * *

It has been that type of year. When we consider how much the world has changed recently, a few things stand out, some obvious, some less reported:

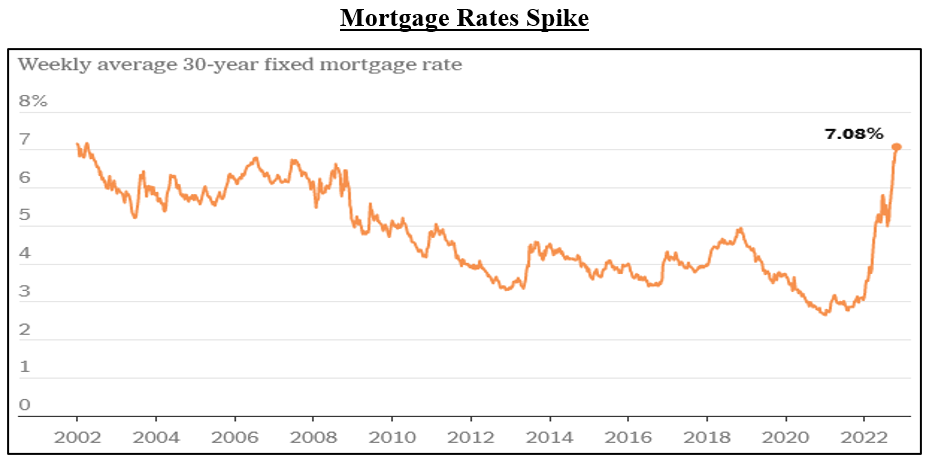

Mortgage Interest Rates: Mortgage rates rose to their highest levels since 2002 in October, easing only slightly since in early November but still at decade-plus highs:

Source: New York Times, October 27, 2022

The impact on homebuyers cannot be overstated. As Charlie Bilello posted on Twitter on October 28, the monthly mortgage payment needed to afford the median-priced home for sale in the U.S. has increased 48% over the last year (from $1,712 to $2,542). For context, wages are up only 5% over the last year. In October, U.S. buyers needed to earn $107,281 to afford the median monthly mortgage payment of $2,682 for a “typical home,” according to a Redfin report. That is 45.6% higher than the $73,668 yearly income needed to cover the median mortgage payment just twelve months ago.

Consumer Debt: Not surprising given where mortgage rates have gone, household debt rose at its fastest annual rate in fifteen years, according to a report from the Federal Reserve released on November 15th. Increases in credit card balances drove most of the consumer debt spike, rising 15% over the same period in 2021 – the largest annual jump in more than twenty years, as reported on CNBC.

Source: Federal Reserve Economic Data

Auto loan balances rose by $22 billion in the third quarter and are now above $1.5 trillion, roughly double the figure a decade ago, according to a report on Bloomberg. As of October, 60% of Americans were living paycheck to paycheck, according to a recent LendingClub report. A year ago, the number of adults who felt stretched too thin was closer to 56%. These are not good trends, especially given the spike in inflation, which disproportionately impacts those who typically carry higher consumer debt.

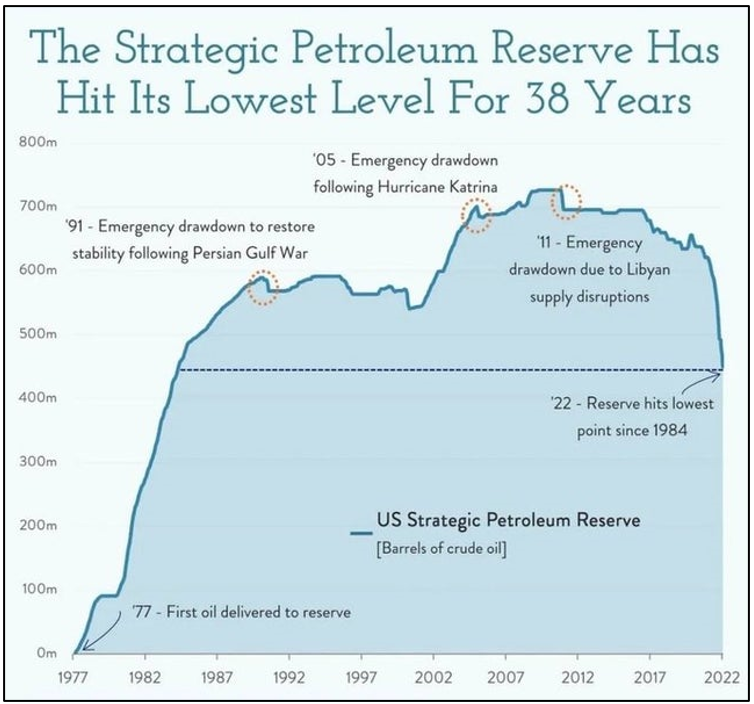

Petroleum Reserve at its Lowest Level Since 1984: The strategic petroleum reserve (SPR) dropped to its lowest level since 1984 over the summer as President Biden authorized the release of approximately 180 million barrels, the biggest release from the SPR since it was created under President Gerald Ford in 1975, according to E&E News, an industry publication.

Source: Reddit

Some skeptics have observed that the move to sell reserve oil came in the months leading up to the mid-term elections, yet the impact at the pump was negligible. Analysts have reported that oil releases may have knocked between just 17 and 42 cents off the cost of a gallon of U.S. gasoline this year. The bigger question is whether the move was prudent given the current geopolitical situation. In our view, anything that can potentially heighten risk for our nation at a time of great global instability and tension must be done with enormous care.

Cyber Tip: The Risks of Auto-Forwarding

Our technology consultant recently brought to our attention the risks associated with rules that allow auto-forwarding outside of your organization, a favorite target of hackers seeking to compromise company emails. Once an email account has been hacked, threat actors create auto-forwarding rules allowing them to receive copies of all incoming emails without having to log into an account each day – and be at risk of triggering a security warning for a suspicious login. In one hack highlighted by the FBI, the hacker implemented a rule to auto-forward any emails with the terms "bank," "payment," "invoice," "wire," or "check" to the cyber criminal's email address.

Companies should create a policy to prevent the creation of rules allowing auto-forwarding outside the organization. By disabling auto-forwarding, the likelihood of a bad actor being able to gain access to emails with sensitive information is reduced. Since the bad actors are very good at covering their tracks, a person whose account has been hacked often has no idea that their emails are being automatically forwarded. The emails often do not show in the ‘Sent’ folder (since the hacker also includes an auto-delete in the rule) and any replies would be re-routed so as not to tip anyone off. Generally auto-forwarding rules cannot be disabled on personal accounts, so everyone should periodically check their personal email account settings to make sure there are no unintended auto-forwarding rules or settings.

* * *

We welcome any questions or thoughts you may have.

Alternative Investment Management, LLC (AIM13)

*In the show, Ted Lasso attributes this quote to Walt Whitman, however the poet never uttered those words. According to an article on Snopes.com, the earliest source comes from a 1986 advice column by Marguerite and Marshall Shearer responding to a mother who found contraceptives in her daughter's bedroom.