AIM13 Commentary - 2018 Q2

“It infuriates me to be wrong when I know I’m right.”

– Moliere

August 15, 2018

Dear Investor,

One of our favorite sayings is that the nice thing about always being bearish is that you are never wrong, just early. When we mention that to people, we often get the retort that being early is the same as being wrong. We disagree. People who think differently than we do tend to focus on short term results or, as we read recently, “live in the microwave generation where everyone wants things fast.” When your only lens is short term returns, being early can definitely equal being wrong. However, by investing a portion of our portfolio in hedged strategies, we do not need to worry about timing. We can “be wrong” and still be right over the long term…

The investing environment remains very challenging this year. Through June 30, the MSCI World Index is barely positive (up 0.4%) and non-U.S. stocks are down -6.7%, according to S&P Dow Jones Indices. Bonds are not providing any relief either: the Barclays Aggregate Bond Index is in negative territory (down -1.1%) through June 30. Despite the S&P 500 again approaching a record high, it is not easy to generate returns this year.

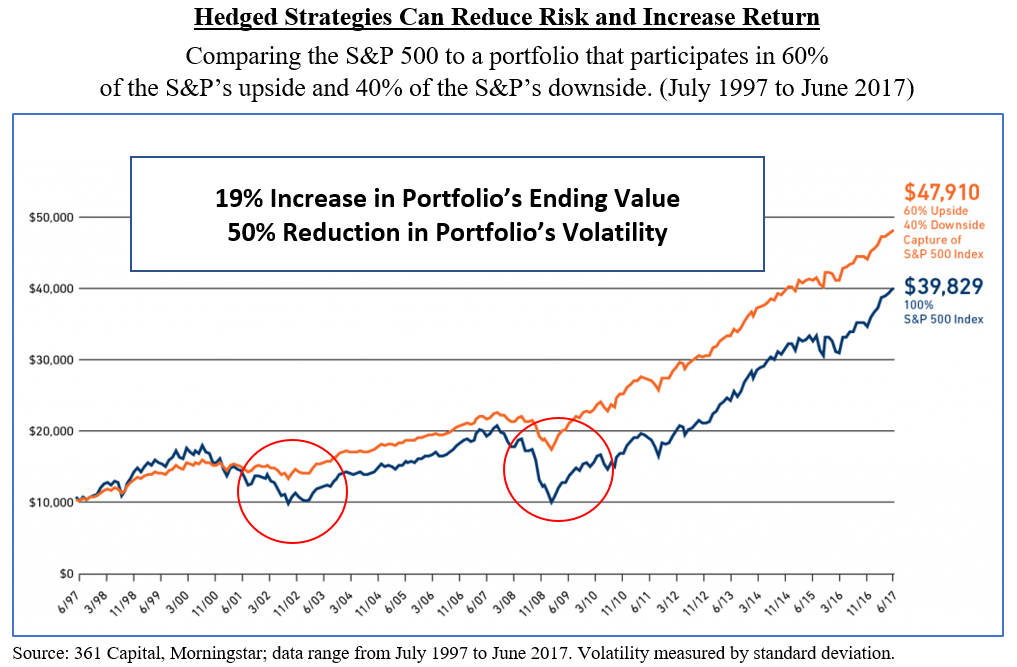

In our view, for our hedged strategy, minimizing losses is central to “being right” over the long term. We recently came across the chart below which graphically reinforces this principle, using the time required to recoup a loss of 20% (which for the S&P 500 is not inconceivable right now given where we are in the market cycle):

We often talk about the virtue of humility when it comes to investing. In the almost 20 years since the inception of our first fund, we have certainly been humbled by the markets many times. However, we are going to put away humility for a moment and declare without qualification that we are absolutely sure there will be a market correction and anyone who says otherwise is a fool who does not know their history. The problem is, of course, we just do not know when it will happen or what it will look like. Therefore, rather than trying to be market timers, we position a portion of our portfolio in hedged strategies that focus on minimizing the downside risk.

Being bearish on the markets obviously is not a popular position. The reason is plain: Through June 30, over the last two years, the S&P 500 TR has had an annualized return of 16.1%, well above its long-term average of approximately 9.8%. At that rate, an investment in an inexpensive index fund would double every 4.7 years. Yet we have positioned our hedged investments conservatively, reducing long-biased fund exposure and adding to managers who have demonstrated skills shorting stocks (they do not include anyone who graduated from college since 2008). During the last two years (or even throughout this entire 9+ year bull market), critics of our approach have classified us as being wrong. Albeit, our funds’ performance is short of the S&P 500 TR during this bull market, but importantly we have managed to generate returns while still remaining hedged.

Whether we are right or wrong to remain hedged during a bull market is certainly a matter of opinion and perhaps, like the hapless characters above, perspective. In contrast, our far greater value to the portfolio, we believe, will come when the market pulls back. We experienced a taste of that in the first quarter of this year when in a two-month period (February-March), the S&P 500 TR was down -6.13%. We are not rooting for a pullback. In fact, our long only public equity and private equity investments have done well in recent years, and for those investments, we hope the party continues! However, when the market does correct, we aim to be prepared to weather the storm.

“I love it when people doubt me. It makes me work harder to prove them wrong.”

- Derek Jeter

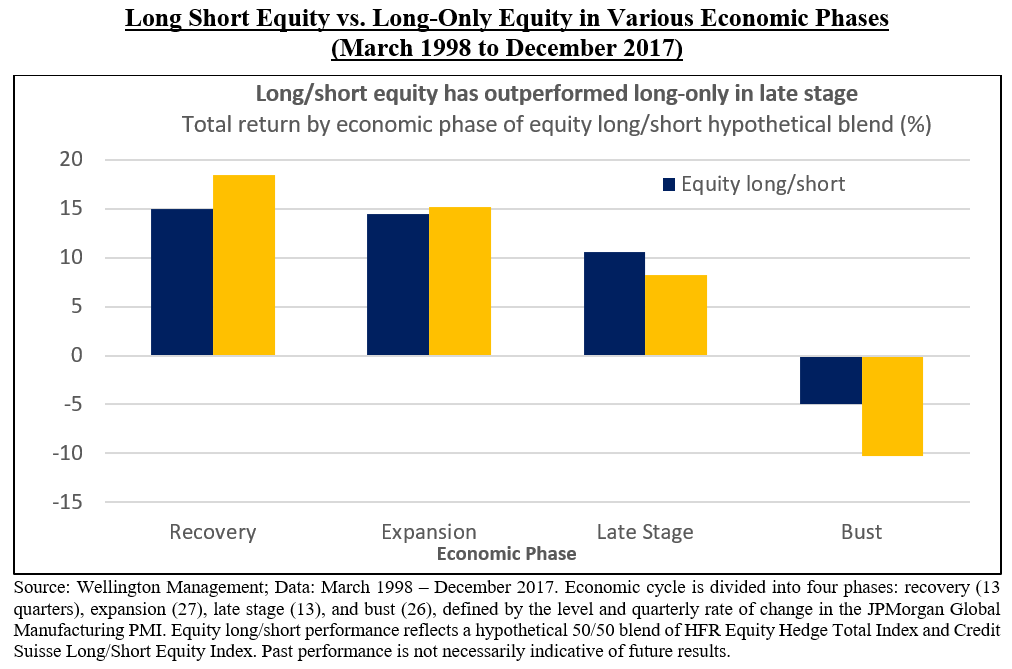

Maybe we are a little annoyed that some people view us as “wrong” about remaining bearish as the market only seems to go up. We know that we will be “right” in the long run. However, for those who are considering abandoning long/short equity, we would like to share this table recently published by Wellington Management:

This chart demonstrates that hedged strategies provide their greatest value late in the economic cycle and through a downturn. Few would argue that we are late in the current cycle and that minimizing the risk of market losses now is as important as ever. As shown below, incorporating a truly hedged strategy can increase the portfolio’s ending value and reduce risk substantially. This is another way to look at the “power of negative numbers” (which we include with every letter) as represented by the chart above:

The bottom line is that, while we value humility, we are happy to say that we know we are right when it comes to the inevitability of market corrections, and we believe remaining hedged provides the best protection from steep losses. In that regard, if being prepared for the inevitable or thinking we cannot successfully time the market over the long term classifies us as being “wrong,” so be it!

Due Diligence Tip

“Intelligence is the ability to adapt to change.”

- Stephen Hawking

One of the greatest risks associated with investing in hedged funds is that the manager you chose to partner with over time becomes a very different manager. Byron Wien wrote about this in his seminal article from 2002, The Inherent Instability of Hedge Funds. He pointed out that outperforming hedge funds necessarily attract capital and grow, and growth brings changes, both to the way the fund is managed and to the business. We see this all the time. The key is how the manager adapts to change.

One way we detect change and how a manager evolves is with our document compare process. We are constantly gathering marketing materials and legal documents from managers that we are watching closely, building up a history of how the manager communicates to LPs. Before we invest, we run “doc compares,” either manually or electronically, and we pay particular attention to changes that relate to a manager’s investment process and strategy. These changes can include:

- Percentage of illiquid investments in the fund

- Average market cap and sizing limits or ranges for securities

- Expected number of positions, both long and short

- Typical portfolio exposures (sector, industry, long/short, etc.)

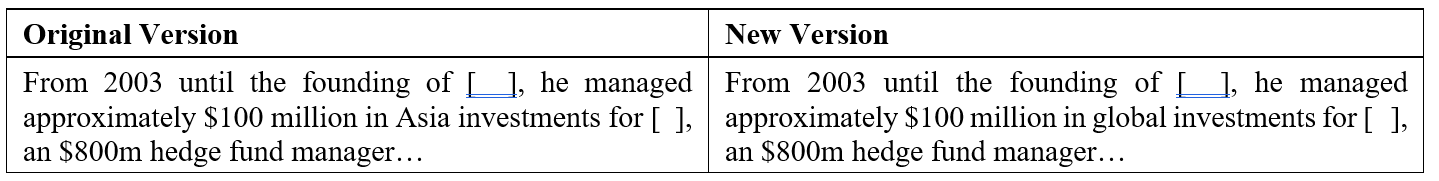

We also see non-investment related changes that can lead to further inquiry. These can include removing AUM breakouts for feeder vehicles or changing an employee’s responsibilities. One manager even changed the description of his work at a prior firm from having previously focused on Asian markets to having been a global analyst:

To confirm our suspicion of the manager’s desire to expand his firm globally, at our next meeting, we cunningly suggested that since he had had success in Asia, he should consider applying his investment acumen globally. He enthusiastically agreed and said that the very same thought had crossed his mind as well... We concluded that was not in our best interests as investors, and this became a part of a mosaic of indicators that ultimately resulted in us redeeming from the manager.

Once invested, we also regularly obtain these materials and continue to conduct this process in our ongoing due diligence. Sometimes changes are for the better, but more often than not they reveal a manager drifting from his or her original mandate and what made them special in the first place. The sooner we see that, the better.

Market Observations

“The takeaway for investors is that it’s a trader’s market that can make or break you. If you ‘know’ the right sector or stock, buy it, and I’ll recognize you since you will be buying at the bar, but if you are wrong, I’ll also recognize you because you will be the one crying over your domestic draft beer.”

- U.S. Equities Report, June 2018, S&P Dow Jones Indices

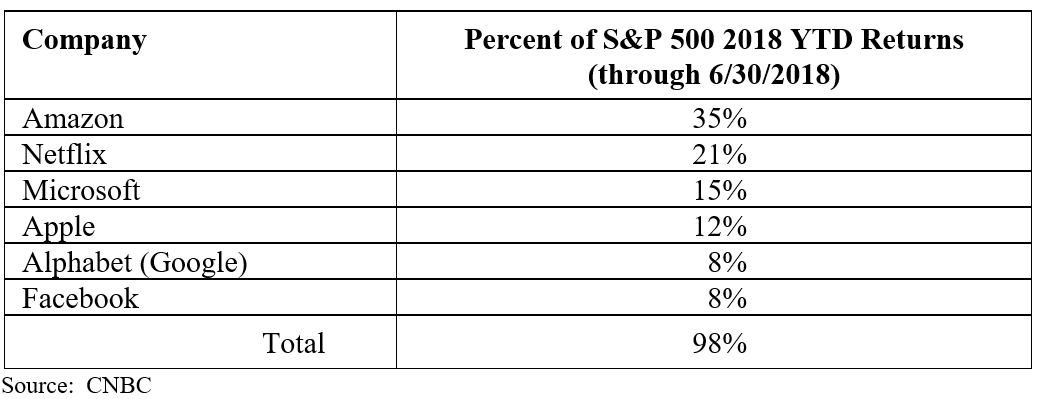

This comment from S&P Dow Jones is consistent with our view that we are living in a highly binary market environment, a view that was reinforced recently when Apple became the first company in history to cross the $1 trillion market cap threshold. To put this in perspective, that is roughly the same market cap as the country’s four major banks (Bank of America, Wells Fargo, JP Morgan, and Citigroup) combined. Yet Apple’s annual revenue of about $230 billion is less than 60% of those banks (combined of $390 billion). When we consider this in the context of how Apple, Microsoft, and their “FANG” companions (Facebook, Amazon, Netflix, and Google) drive the S&P 500 market cap and returns, we become even more concerned about valuations today and the fact that the market is increasingly lopsided. In fact, consider that those six stocks accounted for about 98% of the S&P 500 returns in the first half of 2018:

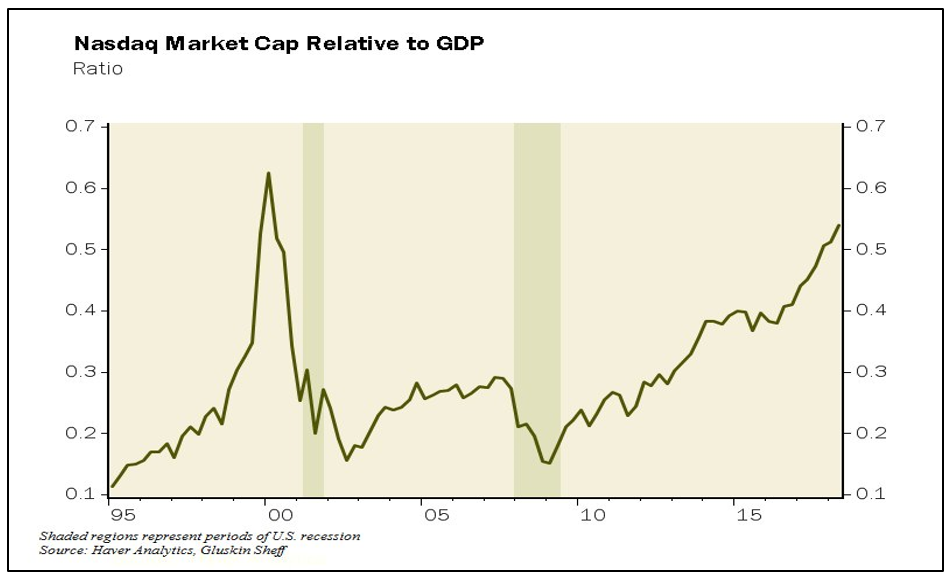

Of course, this was before Facebook hit a major air pocket on July 26th and shed approximately $100 billion in market value in one day. However, these dynamics – ballooning market caps of a small handful of companies whose performance, in turn, drives the S&P 500 returns – worry us about more widespread risks in the broader market. A related indicator is the total market cap of the NASDAQ relative to U.S. GDP. As the chart below demonstrates, this measure is approaching the bubble peak of the dotcom era:

Other areas of concern include:

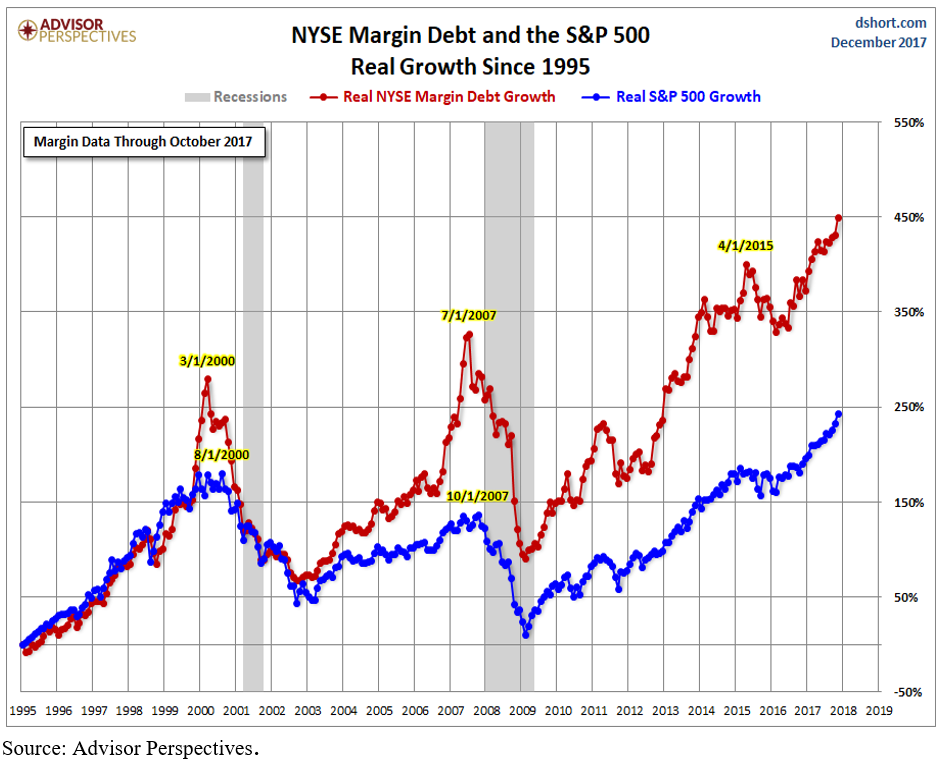

- Investors on Margin. One trend that has not gotten a lot of attention is the steep increase in investors’ margin debt. In fact, margin borrowing (in absolute terms) now stands at 1.7x the August 2007 high; 2.3x the March 2000 high; and 14.7x the September 1987 high, according to a report by William Darusmont in Seeking Alpha. Similarly, the chart below illustrates how margin debt is growing much faster than the S&P 500. This is troubling because high margin accelerates asset sales when prices decline.

Investors with high margin debt balances should be reminded of one of Ira Harris’s favorites quotes: “The quickest way to make a small fortune is to start with a large one and lever it up...”

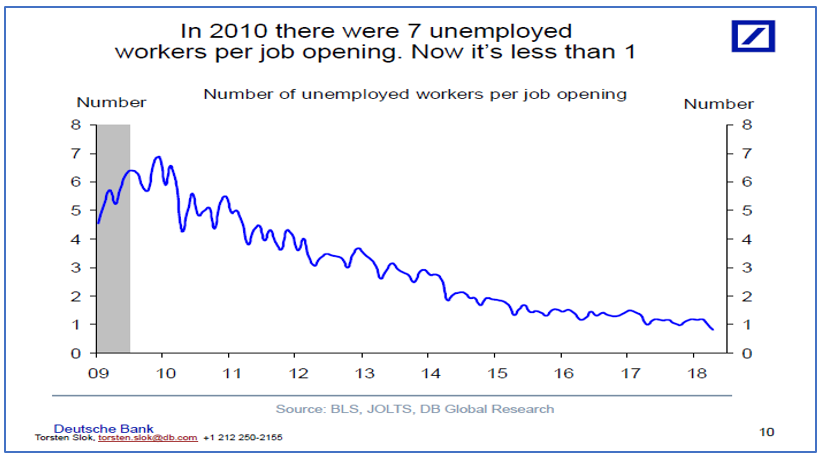

- Tight Job Market. Unemployment ticked down a notch again in July, with the unemployment rate dropping to 3.9%. According to Deutsche Bank, it currently takes 31 days to fill a vacant job, up from 23 days in 2006 and higher than it has been since they started tracking it in 2001. In fact, the number of unemployed workers per job opening recently dropped below one:

The most immediate effect of low unemployment is wage inflation. Certain sectors are particularly vulnerable, such as industrial and consumer discretionary firms. Likewise, small-cap companies often do not have the margins to cope with rising wages, and some small firms have to dip into a less talented work pool which can, in turn, reduce productivity. Addressing the risk of low unemployment as it relates to smaller firms, Goldman Sachs pointed out earlier this year that, "We estimate that a 100 bps acceleration in labor cost inflation would pose a 2% headwind to Russell 2000 EPS, roughly double the 1% impact we estimate for the S&P 500." While low unemployment generally is good news for the economy, it can also mean lower profits and lower equity market valuations.

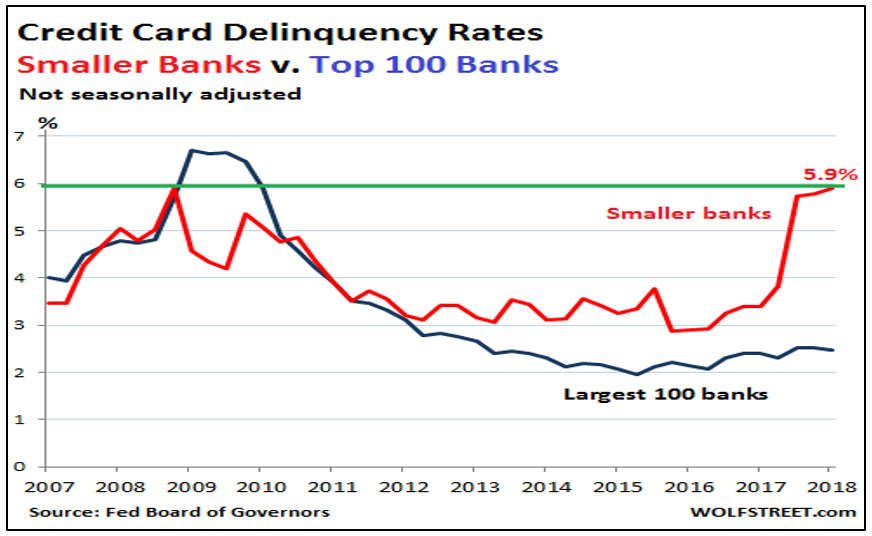

- Credit Card Delinquency. We wrote about the overall size of the consumer credit market one year ago in our second quarter 2017 letter when the debt level crossed the $1 trillion level. Since then, we continue to see troubling signals from that portion of the credit market. In LendingTree’s July 2018 Outlook, the firm noted that in May 2018, revolving debt increased by $16 billion, the largest percentage increase since 1995. While delinquency is not high among home lenders, there is one segment of the consumer credit market which is showing signs of stress, namely credit cards issued by smaller banks:

Spiking delinquency rates among small banks is especially disconcerting because the largest banks have successfully maintained strict underwriting standards since 2009. Not so the smaller competitors, which are attracting new customers with lower credit quality requirements. That is OK so long as incomes continue to rise. The steep increase in delinquencies in the second half of 2017 and continuing into this year suggests all is not well among lower income earners.

Closing Thought

Anyone who, like us, has young children is astounded at the pace of technological change and how it affects everyone’s lives. One result of the rapid pace of change is how quickly an “older” generation can become out of touch with a “younger” generation (we will not put ourselves into either category!). This was brought home to us in April when Mark Zuckerberg appeared before Congress. With credit due to Minda Zetlin at Inc.com who compiled the list below, members of Congress actually asked the following questions:

- “Is Twitter the same as what you do?” (Senator Graham)

- “How do you sustain a business model in which users don't pay for your service?” (Senator Hatch)

- “If I’m emailing within WhatsApp… does that inform your advertisers?” (Senator Schatz)

- “What was Facemash, and is it still up and running?” (Representative Long)[1]

- "Would you bring some fiber, because we don't have connectivity?" (Senator Capito (West Virginia))

Our favorite wasn’t even a question: "My son is dedicated to Instagram, so he'd want to be sure I mentioned him while I was here with you." (Senator Blunt) We are sure Senator Blunt’s son got a lot of likes for that!

We welcome any questions or thoughts you may have.

Sincerely,

Alternative Investment Management, LLC

[1] If you are familiar with “The Social Network,” you may remember that Facemash was a Zuckerberg website in which users chose between two photos of women (you can guess the basis of the comparison). Zuckerberg created Facemash in his dorm room at Harvard years ago. Not surprisingly, Harvard shut it down within a few days of its launch.