AIM13 Commentary - 2024 Q4

“Success is like pregnancy. Everybody congratulates you

but nobody knows what you went through to achieve it.”

In looking back over the decades that we have invested our capital and those of our partners who invest alongside us, we have learned that the most successful investors almost always share a few important qualities that are easy to spot but extremely rare in combination. We have been looking at managers for more than 30 years and, since January 1, 1999, have aligned our capital with others to invest and partner with the very best investment minds. In this letter, we lay out what we think are the eight most important traits that make a great investor, the rare person who can overcome obstacles and succeed when it is not always easy.

The Eight Traits That Make A Great Investor

“Nothing endures but personal qualities.”

Every year we hire interns to join us for the summer, and we hope at the end of the program that they learn a little about how to be a good investor. More importantly, however, we try to impart on them what we think are the qualities of a successful professional, tailored to the field of finance but equally applicable to wherever life may take them. With the benefit of doing this now for 25+ years, we thought it would be helpful for our partners and ourselves to revisit the qualities that we think make a great investor:

Integrity

Honesty and Transparency

Perseverance and a Desire to Always Improve

Simplicity

An Appropriate Appreciation of Risk

Patience and the Ability to Think Long Term

Alignment of Interest

Humility

1. Integrity

“Past performance is not indicative of future performance,

unless you’re talking about someone’s character.”

Integrity for us means living by unmutable principles or, as C.S. Lewis put it, “doing the right thing, even when no one is watching.” Above all else, being grounded by a moral code is the basis upon which everything else about investing is built upon. Yet, people’s confidence in your integrity is the easiest thing to lose. Warren Buffett once said, “it takes twenty years to build a reputation and five minutes to ruin it.” It is easy to do the right thing in good times; integrity means doing the right thing in difficult times. Great investors have the self discipline and courage to stay true to what is important to them, whatever is happening around them.

2. Honesty and Transparency

“Do what you say and say what you do.”

Closely aligned with integrity is the virtue of honesty and of being forthright with your partners. In our world, like integrity, this is most often tested during periods of adversity, since no one wants to share bad news. We have all seen what goes wrong when investors hide things, misrepresent the truth, or even outrightly lie. Usually this begins with a small lie which seems harmless at the time. “Sunlight is the best disinfectant,” Justice Brandeis famously said, and the managers who are candid and open about what they do typically are the ones you want to partner with. For instance, great investors can go on the offense when things go wrong when others are more focused on how and what to tell their partners.

3. Perseverance and a Desire to Always Improve

“The road to success is dotted with many tempting parking spaces.”

We live in a time of that emphasizes positive as opposed to negative feedback, that awards seventh place finishers with trophies and that fosters “safe places” where any hint of criticism or constructive feedback is considered anathema to one’s well being. That way of thinking ignores the reality of failure, of making mistakes and of coming up short. Even Ted Williams “only” hit .406 in the best year of batting in baseball. Great investors recognize their mistakes, learn from them, and ultimately overcome and persevere to be better at what they do. As Thomas Edison once quipped, “I have not failed. I’ve just found 10,000 ways that won’t work.” A lot of people take short cuts that make them seem successful in the short term but at the end of the day, there are no short cuts to long term success. We wake up every day thinking about how we can be better and how to implement that going forward.

4. Simplicity

“Simple can be harder than complex. You have to work hard

to get your thinking clean to make it simple.”

Highly intelligent people have the ability to manage complexity, and that is often necessary to be a great investor. However, reducing complexity, identifying what is important, and boiling down things to what is essential to focus on is often very hard to do. We have all seen the manager with the strategy that cannot be explained or understood without a PhD – and all too often it is the overly complicated strategies that are the ones that blow up in unexpected ways. Keeping things simple allows you to “keep your eye on the ball” and not be blindsided by the unanticipated when something goes wrong.

5. An Appropriate Appreciation of Risk

“Being a Navy SEAL and sniper taught me all about risk management.

Take away all the risk variables under your control and reduce it to an acceptable level.”

Readers of our letters know that we spend a lot of time thinking about risk and, some might say, worrying about what can go wrong. One of our favorite sayings is being bearish means you are never wrong, just early. Great investors appreciate risk, however this does not mean they avoid it at all costs. They manage and understand it, and use that understanding to their advantage. As hedgeD equity and credit investors who use private equity, debt and other strategies as a part of our overall portfolio, we strive to balance risk and reward for superior performance over time. As we like to say, just because you got away with it does not mean you didn’t take any risk.

6. Patience and the Ability to Think Long Term

“If you wait at a bus stop long enough, you’re guaranteed to catch a bus,

but if you run from bus stop to bus stop, you may never catch a bus.”

One of the hardest things to teach a young analyst is patience and the importance of thinking long term. Things do not always happen quickly, and too many investors think it is always “up and to the right.” In today’s world of instant gratification or of public companies living quarter to quarter, the power of compounding over time – what Albert Einstein called the eighth wonder of the world – is not sexy or interesting to a lot of investors. With decades of experience of investing, we think that is a huge blindspot. We like to remind ourselves that if you invested $1,000,000 dollars with one of our managers at his fund’s inception in 1995, that would be worth approximately $250 million today. Enough said!

7. Alignment of Interest

“If everyone is moving forward together, then success takes care of itself.”

The greatest managers recognize that without their partners, they wouldn’t have a business. Yet often with success, managers lose sight of this and their partners’ capital becomes “other people’s money.” Interests diverge when the managers focuses more on management fees, asset accumulation, and enriching themselves. As primarily a family office investing our own capital side by side with that of our partners, we understand the importance of alignment and always invest our own capital in opportunities that we make available to our partners. We put incentive fees above management fees, and returns before assets under management, and we try to only partner with investors who think the same.

8. Humility

“If you let your head get too big, it’ll break your neck.”

We put humility at the end of the list not because it is less important than the others. To the contrary, without humility, an investor will not recognize his or her own shortcomings and that always leads to trouble. We put it at the end of this list because if one is fortunate enough to have all of the other traits above, being humble and knowing you are still not perfect does not come easily. To paraphrase Thomas Carlyle, the greatest of faults is to be conscious of none.

“A man who correctly guesses a woman’s age may be smart, but he’s not very bright.”

We did not include on our list of the most important traits of a great investor things like intelligence, curiosity, analytical skills, memory, and just the sheer brain power that some people are naturally endowed with and are admittedly must-have’s to be a great investor. Nor have we included things like kindness, charity, generosity, and an even temper that make great investors great people, which at the end of the day is the most important thing of all. All of these qualities must be in the mix, but we think the eight traits above are foundational for all great investors, and we strive to foster and develop these traits in ourselves and those around us.

* * *

Market Commentary

“I’m actually pretty negative for the first time in a while. It may only last a year or so, but it’s definitely a period where I think the best gains have been had, and it wouldn’t surprise me to see a significant correction.”

Following the Trump election, things in the markets and in the world seemed to have move into high gear, regardless of how you feel about what is happening. We live in a very uncertain time, and our outlook has never been more cautious.

Some things that keep us up at night include:

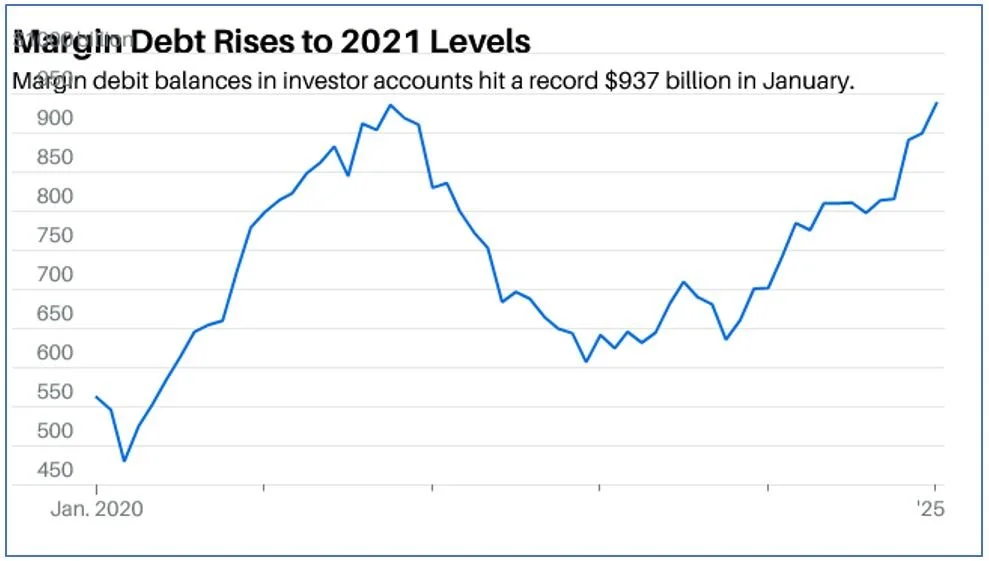

Margin Levels. Margin debit balances hit a record $937 billion in January, up 33% from twelve months prior and topping levels last seen in 2021, according to FINRA and as reported by Barron’s:

Source: Barron’s

One driver of increasing margin debt is the retail investor’s increasing access to margin. The Times in London reported at the end of 2024 that Robinhood expanded its margin loan program into the U.K. Leaving aside the increased volatility that comes with leverage, a lot of people fear that investors may not appreciate that they could end up owing more than they started with.

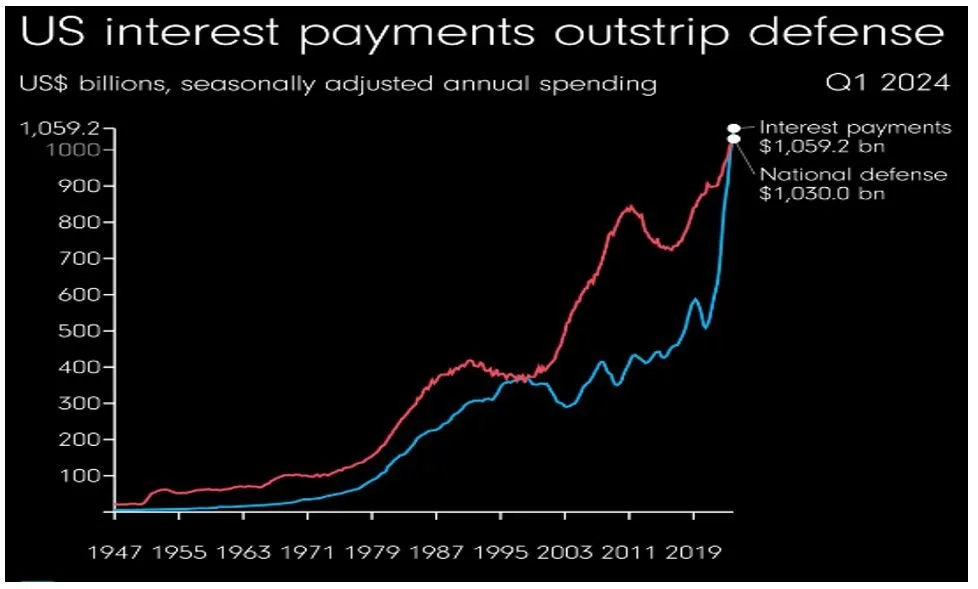

National Debt. Federal debt as a percentage of GDP is at about 98%, an all-time high post World War II, according to the Peter Peterson Foundation. As reported in the Wall Street Journal, net interest expense on the national debt amounts to about $2,646 per person, more than Medicare and national defense:While the views on the impact and consequences of spiralling national debt may vary, there is consensus that it is not a good thing. The Brookings Institution issued a paper in February entitled, “Assessing the Risks and Costs of the Rising US Federal Debt” that highlighted the risk that the demand for Treasuries may evaporate if investors lose confidence that the Treasury can avoid default or that the Federal Reserve cannot prevent hyperinflation, both of which would send us into an unprecedented financial crisis.

Source: @JamesEagle17 on LinkedIn; St. Louis Federal Reserve

While the views on the impact and consequences of spiralling national debt may vary, there is consensus that it is not a good thing. The Brookings Institution issued a paper in February entitled, “Assessing the Risks and Costs of the Rising US Federal Debt” that highlighted the risk that the demand for Treasuries may evaporate if investors lose confidence that the Treasury can avoid default or that the Federal Reserve cannot prevent hyperinflation, both of which would send us into an unprecedented financial crisis.

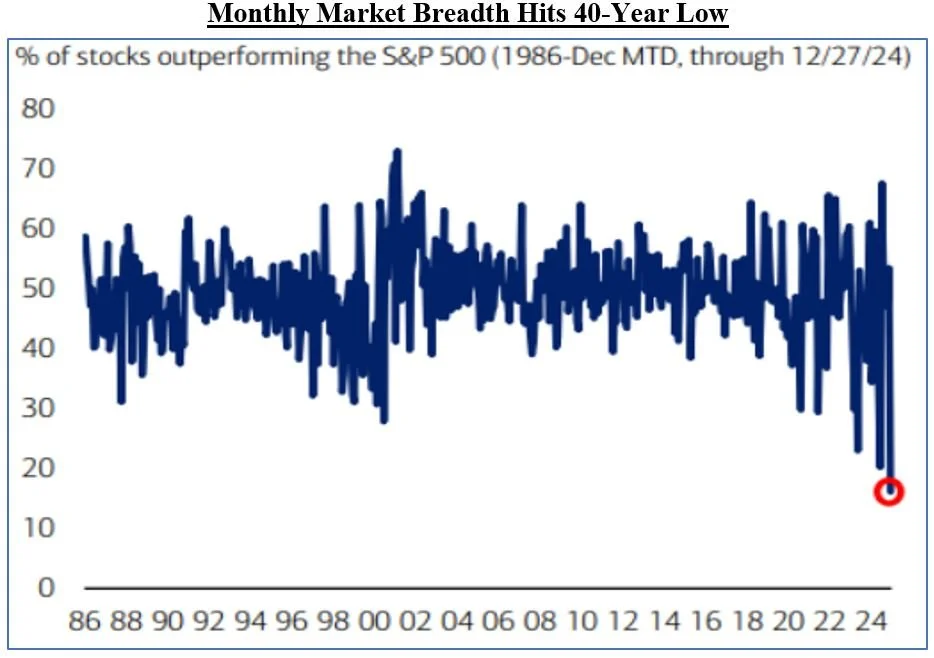

Concentrated Market. At the end of 2024, Barron’s reported that the market had a case of “bad breadth.” The biggest stocks, most notably the Magnificent Seven, were perceived as the least interest-rate sensitive and therefore were doing much of the market’s heavy lifting:

Source: Factset, BofA US Equity & Quant Strategy

Things have somewhat improved in 2025, yet many key indicators of market breadth remain troubling. For instance, in February, the advance-to-decline ratio (a measure of the number of rising stocks versus those declining) fell to 0.77, which is the lowest reading since March 2020, when it hit 0.72 in a pandemic-induced global selloff, as reported on Moneycontrol.com. This is the third consecutive month and the seventh instance in the past one year when the ratio has fallen below one. In 2024, only 29 companies in the S&P 500 outperformed the index, well below the long-term average of 48%, according to Northwestern Mutual. Combine this with similar results in 2023, it is tempting to draw parallels to the market dynamics of the late 1990’s.

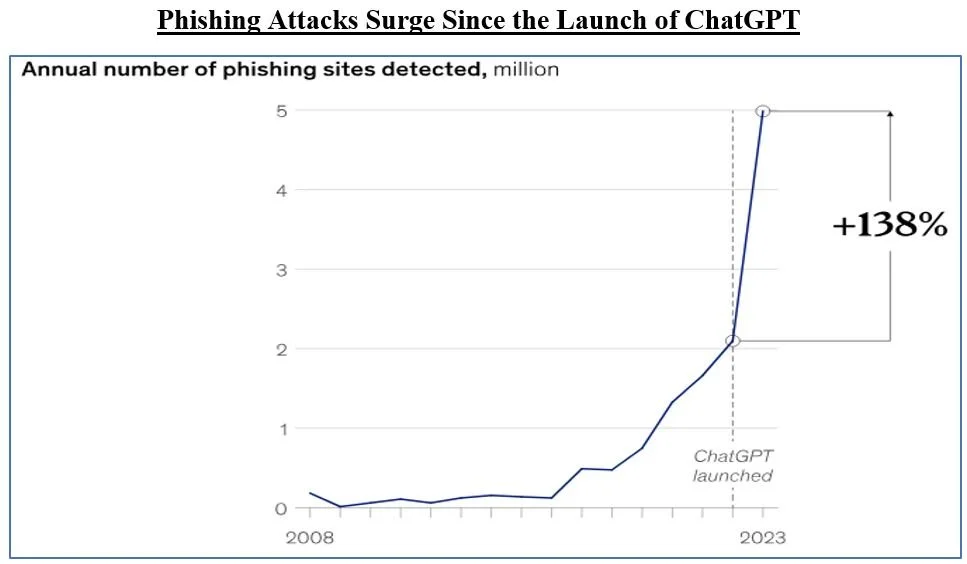

Cyberattacks Using Generative AI to Accelerate Phishing. At the end of February, CrowdStrike issued its 11th annual 2025 Global Threat Report which highlighted among other things the rising prominence of artificial intelligence in cybercrime. Generative AI is now widely adopted for social engineering, phishing, deepfake scams and automated disinformation campaigns. According to McKinsey, the launch of ChatGPT and similar tools may have accounted for a more than doubling of phishing attacks:

Source: McKinsey & Company, State of the Phish Report, Proofpoint 2023

Notable AI campaigns identified by CrowdStrike include the North Korea-linked group FAMOUS CHOLLIMA which used AI-powered fake job interviews to infiltrate tech companies. According to a Wagner Law Group paper issued in February, hackers pretend to be remote tech hires, falsifying resumes, generating profiles via AI and utilizing deception during hiring. Once hired, they use “laptop farms” to disguise their location, pretending to be in places like the Philippines or India and collecting a salary while also harvesting sensitive data and learning critical details of corporate IT and security infrastructure for later sale or direct exploitation. AI is an enormous technological advancement, but in the wrong hands it can be an equally dangerous, even scary, tool.

We welcome any questions or thoughts you may have.

Alternative Investment Management, LLC (AIM13)