AIM13 Commentary - 2023 Q4

“Successful investing takes time, discipline and patience… You can’t

produce a baby in one month by getting nine women pregnant.”

One of the biggest problems we see today is that most people think short term, most visibly in making investment decisions but also especially when it comes to building relationships and a network. We know that, based on our experience investing in the markets and partnering with smart investors for over twenty-five years, investors who do not think long term eventually will get burned. Unfortunately, too many people do not think about where they will be and who they will want to have close to them in five years, ten years, or even twenty-five years. They want everything now. If something does not give almost instant gratification, they give up on it and jump to the next thing. They fail to recognize that, like anything worth achieving, building a real and productive network and generating superior returns both take a lot of time.

Unlike a lot of investors, we believe that our structure as primarily a family office investing our own capital provides us the advantage of time and the luxury of thinking long term. While we are as guilty as anyone as we do look at monthly, quarterly, and annual returns, we also work hard to focus on the long term. For most people, time is the thing in shortest supply. For us, we recognize that time is our most valuable asset, and we try to use it as efficiently and productively as possible.

The most visible way we think long term is in our network and the people we have worked hard to cultivate as our friends, partners, and colleagues over our lives and in particular the 25+ years we have been investing. We have often said that if you surround yourself with smart people, good things will happen. The problem is that it takes a lot of time to build a genuine network. Long term relationships are not built overnight by social media and Instagram or Facebook, and their quality is not measured in the number of likes or followers. Those contacts are transactional. Our kids have often told us that if someone “likes” something you did, it is almost an insult not to “like” them back.

“The currency of real networking is not greed but generosity.”

Building a real network is not about quid pro quo. It requires being helpful to others without the expectation of something in return. We were recently having dinner with a friend, and the check came and they wanted to itemize who would pay what. If you go to dinner with other people long enough, it all works out. Yes, there will always be people at a group dinner who order the lobster special and then suffer from “alligator arms” when the check comes. Those are not the people you want to invest your time in.

“I’ve learned that you shouldn’t go through life with a catcher’s mitt

on both hands. You need to be able to throw something back.”

We may be dating ourselves but too often we find people who are too occupied with their own interests and too engrossed in their own daily lives to think about others. They pick up the phone only when they need something. Relationships are built not only getting things from others but on a sincere interest in what people are doing and treating other people right. In a lot of cases, we do not get an immediate benefit cultivating relationships. However, over time, connecting with people, helping out when we can, and staying in touch pays dividends.

“Find a group of people who challenge and inspire you;

spend a lot of time with them, and it will change your life.”

Finding those people who will make a difference in your life is challenging. When we evaluate investors we are considering partnering with, we try to view them less as a “snapshot” of who they are today and more as a “movie,” with a history we can assess and use to form a basis of who they will be in the future. We do this by drawing on the people around them – their childhood family and classmates, college friends, and colleagues from prior work experiences. Considering this history, we try to understand what motivates them and how we can help them and eventually they can help us. With this approach, even having just met someone, we can leverage our network to build a mosaic of who they are and use that to decide if we want to partner with them and add them to our network.

An Evening with Michael Morrell

We recently had the pleasure to host a small dinner with people from the world of finance, investing, corporate America, and current and former government officials featuring Michael Morrell, the former Deputy Director and twice Acting Director of the CIA from 2009 to 2013. Chris Darby, who recently resigned as head of In-Q-Tel, the CIA’s investment arm, moderated the conversation. The primary takeaway was that there are credible scenarios for some very scary things to happen across various current hotspots across the globe. Be it an invasion of Taiwan, a widening of the Israel-Hamas war, the Houthi crisis in Yemen, or an escalation of the Ukraine-Russia conflict involving the military involvement of western European countries, Mr. Morrell analyzed each in the context of a worst case scenario. While the probability of a global-scaled catastrophic turn in each conflict is low, when considered together, along with the less known threats here and abroad, we believe that geopolitical stability is the lowest it has been in decades.

Our Observations for the Quarter

Immigration and an Unsecure Border. We will not wade into the debate of who is to blame for the current migrant crisis in this country, as we try not to lean politically in these letters. However, the astounding spike in illegal immigration – and its consequences – cannot be ignored:

Annual Southwestern Border Apprehensions

(By fiscal year Oct 1 to Sept 30)

Source: The New York Times, 10/29/23; based on data from U.S. Customs and Border Protection; by fiscal year, from October 1 to September 30; only encounters between ports of entry are shown.

We most regret the terrible humanitarian suffering and the plight of so many looking for a better life here in the U.S. Beyond that, we are also concerned about the risk of crime and terrorism associated with having so many undocumented people coming into our country. While the data generally does not support a direct link between illegal immigration and terrorism, it cannot be questioned that our national security is lessened with a less secure border.

Inflation, the $18 Big Mac, and the Tooth Fairy. Hedge fund manager Kyle Bass was the subject recently of widespread ridicule for his complaints about “a terrible inflation milestone” following his $85 breakfast reportedly at New York’s Carlyle Hotel. No serious person would solely blame inflation for the exorbitant cost of breakfast at the Carlyle. More telling about the current state of inflation was when McDonad’s CEO Chris Kempczinski said in February that customers making less than $45,000 per year have largely stopped ordering from McDonald’s. This does not surprise us when the cost of a Big Mac, fries, and a drink has risen to nearly $18 at some locations, as reported by the New York Post, a report which was then topped by news last week of the same meal costing $24 at Five Guys! Even the Tooth Fairy (that is, your average mom or dad) is feeling the pain of inflation:

Source: New York Post, 2/22/2024.

All kidding aside, the regrettable truth is that inflation disproportionately impacts low-income households who spend greater proportions of their income on necessities such as rent, gas, and food which all have higher than average inflation rates, according to the Federal Reserve. After inflation reports for January and February were less encouraging than expected, the sooner we get it under control the better.

Inverted Yield Curve. An inverted yield curve occurs when long-term interest rates on U.S. government bonds fall below their short-term equivalents. Currently, the 2-year interest rate is approximately 4.5%, while the 10-year rate is about 4.2%. Inverted yield curves are not uncommon when the Federal Reserve has raised interest rates as it has done recently to reduce inflation. In that rate environment, if history is any guide, most predictive models hold that a recession is still more likely than not in 2024:

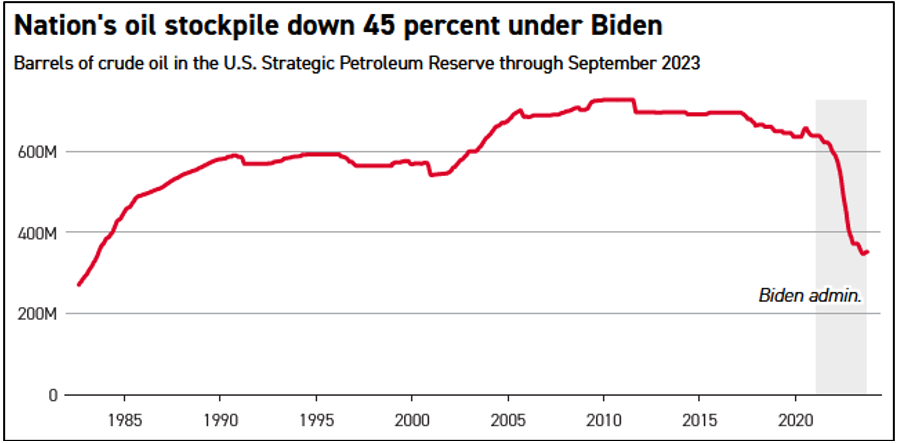

Reduced Strategic Petroleum Reserve. During his administration, President Biden has implemented one of the most aggressive drawdowns of the Strategic Petroleum Reserves in history, selling off more than 40% of the SPR. The program was first initiated in response to rising gasoline prices, and it achieved its purpose. According to the Treasury Department, Biden’s sales of oil from the reserve reduced gasoline prices by up to 40 cents per gallon. The program then was continued as a result of Russia’s invasion of Ukraine:

Source: Politico based on data from U.S. Energy Information Administration 10/16/2023

There is enormous risk to this strategy. A Forbes report in late February noted that “if geopolitical events disrupt the oil markets, it will look foolhardy in hindsight, and there will likely be repercussions.” Given what is going on in the Middle East and Russia right now, we think the strategy is, at the very least, concerning.

Personal Security Tip

The latest iPhone update includes a new feature called “Journaling.” According to Yahoo News, the app is “designed to be like a digital diary, with the option for users to pin locations and upload photos alongside their writing, as well as daily writing and reflection prompts.” One component of the app is a feature found in the Privacy & Security settings called “Journaling Suggestions.” It has an on/off toggle labeled “Discoverable by Others.” If this toggle is on (which is how it comes), anyone nearby can find you and locate where you are. If, like a lot of people, you do not want the iPhone belonging to anyone close to you to be able to detect you or your devices, you should turn this off.

We welcome any questions or thoughts you may have.

Alternative Investment Management, LLC (AIM13 )