AIM13 Commentary - 2021 Q4

“The irrationality of a thing is no argument against its existence.”

We write this letter to our partners at a time of great sadness for the people of Ukraine and of great concern for global security. Of course, while the human cost of the conflict is its greatest tragedy, its effect on markets and the economy cannot be overstated. As the price of oil recently surged past $130 per barrel, its highest since 2008, we are reminded once again of how quickly the investing environment can change.

We also write at a time of great personal loss. On February 21, 2022, the AIM13 family lost its mentor and friend, J. Ira Harris. Ira instilled in us many of the qualities we embrace at our firm, including treating partners as true partners, thinking long-term, and striving to do the right thing. We will continue to work hard every day to honor these core beliefs which he embodied.

* * *

Against a backdrop of great upheaval, we turn to consider hedge fund performance in 2021. The year was one of the most disappointing return years for us as hedge fund investors in our twenty-three year history. While we strive to remain disciplined and focused on the long term – and not just on any quarter or year – 2021 caused us to re-underwrite any assumptions that we hold and to spend considerable time re-evaluating the structure of the market. Despite the underperformance, we still maintain high conviction in having a portion of our overall portfolio in a hedged strategy. Moreover, with the Fed’s stimulus easing coming to an end and inflation forcing their hands to temper the overheating economy by raising rates, we believe managers should be able to generate alpha equally both on the long and short sides of the portfolio. In other words, now is not the time to abandon hedged funds.

In speaking with other investors, however, there are people who view themselves as long term investors and if they buy any dip, they will dramatically outperform over the long term. Unlike them, we do not feel the decade ahead will be a repeat of the last ten years. We expect more volatility and, at best, sideways moves in the markets in the years ahead. As such, we believe experienced hedge fund managers should be a component of any equity portfolio.

While as of this writing the S&P 500 Total Return Index (“S&P 500 TR”) is down year-to-date approximately (10%), there are still those who think the market just goes straight up, and such pullbacks as we are experiencing now will be short lived. (Incidentally, we believe many of them were sellers in late March 2020.) For such people, hedge funds do not make sense, and they should invest all of their equity exposure in levered ETFs. Needless to say, that is not our view. We have gone through rough patches before, but we know that panicking and losing discipline would not serve us well in the long term. We remain focused on what we need to do over the next one, three, and five years – that is, deliver superior returns on our own capital and the capital of our partners invested alongside us.

As we re-underwrite the portfolio, we continue to ask ourselves the most important question about each manager: if we were not invested with the manager today, would we invest? If the answer is not a resounding yes, then we must redeem. Our ongoing due diligence is always a priority.

* * *

We chose the irrationality quote for our letter in early February, well before the invasion of Ukraine, though now it has timely applicability to the man singularly most responsible for the war. Beyond what is going on in geopolitics, we see a lot of irrationality right now in the markets.

“Stock prices have reached what looks like a permanently high plateau.”

Irrationality has happened before, as the observation above reminds us, made by a leading economist weeks before the greatest collapse of stock prices in our history. However, 2021 was a particularly unsettling and at times irrational period for investors. When we consider hedge fund performance relative to the S&P 500 TR over the course of the year, it is worth recalling some of the more unprecedented (and troubling) events and trends in the markets and the economy during the year:

In the period April through early December, just five stocks (Microsoft, Google, Apple, Nvidia, and Tesla) accounted for 51% of the S&P 500’s return.

At year end, inflation reached 7%, its highest rate since June 1982.

Yet gold, an inflation hedge, lost roughly (3.5%) in 2021, its worst return since 2015.

Household debt rose by $1 trillion in 2021, the most since 2007, according to the Federal Reserve.

More Americans have quit their jobs – a record 4.5 million in November 2021 alone – bringing the total “Great Resignation” in 2021 to over 38 million people in the first 11 months, the highest ever.

The “meme stock” rally of January ended up costing investors in four companies (Gamestop, AMC, Peloton, and Robinhood) upwards of $191 billion from peak to a trough set earlier this year.

This is to say nothing of a riot within the nation’s Capitol, a COVID variation that caught nearly everyone off guard, supply chain disruptions, and uncertainty around the extent of rising interest rates. The U.S. consumer is also under increasing pressure. With the support of stimulus checks going away and higher prices for virtually everything, disposable income is set to shrink on an inflation-adjusted basis. Indeed, researchers at Harvard’s Kennedy School calculate that inflation-adjusted wages are nearly 3% below the pre-pandemic growth trend, according to a report in Time in late December. Suffice it to say, 2021 was a challenging time for investors even though the S&P 500 TR posted a strong return and closed at 70 all-time highs in 2021, the second most in history (1995 had 77). At times, the market return is difficult to reconcile with what is going on in the economy and the world.

Against this backdrop, the difficulties in shorting stocks continued through 2021, as we wrote in our second and third quarter letters. With multiples contracting without regard to company performance, the usual dampening effect that single name shorts provide was muted. At the same time, managers have reduced short interest across the markets, with year-end levels at their lowest since 2000. Finding managers who can navigate this environment has been one of our highest priorities.

Volatility returned to the equity markets in January, with the S&P 500 TR down during the month about (9.16%) through January 27th, only to bounce back 4.38% in the last two trading days. Of course, had the month ended on January 27, on a relative basis, the value of hedged strategies in the period would have been more apparent – which just reinforces the reality that calendar months are arbitrary periods, and long-term returns are what really matter over time. However, while we do not focus on short term results, we do not ignore them.

Now we are seeing continuing volatility as a result of the invasion of Ukraine. Just two months into the year and we have already seen historic moves in stock prices. Indeed, at one point as of late January, 55% of the companies that comprise the NASDAQ were down greater than 50% from their all-time highs. In early February, Facebook set the record for the largest market cap dollar decline in a single day – only to be followed by Amazon posting the largest market cap increase in one day. As year-end earnings are released, Deutsche Bank published a report recently indicating that the market has become less enthusiastic about market beats and more punishing following misses: Companies that beat estimates have outperformed the index by 0.2% versus 0.5% historically, while companies that missed have underperformed by a record -4% versus -1.6% historically, according to the report. In this environment, we believe we will see a shift in managers’ gross exposure from long to short, creating tighter nets in the portfolio. With the end of a decade-plus run of free money where rates were hovering at historic lows, we expect volatility to continue into this year and opportunities for profitable shorting to improve.

“The most contrarian thing of all is not to oppose the crowd but to think for yourself.”

Our current long term outlook is grounded in two overriding principles: First, downside protection matters more now than it has in over a decade, really since the Great Financial Crisis. We have written regularly about the “power of negative numbers” and include a simple chart at the end of this letter reminding people that the more you lose, the more you need to make up on a percentage basis to get back to even. Investors now risk losses in the equity markets of a magnitude that can take years to recoup.

“He who loses the least in a bear market wins.”

The second principle is that markets can go down and stay down for a long time. Since January 1, 1999, the S&P 500 has had 23 rolling ten-year periods of negative performance. The NASDAQ was flat for the period March 2000 to April 2015 – fifteen years! Investors often forget this, especially when it has been some time since it happened.

With those principles in mind, our view on portfolio management is that if one feels that, aside from temporary pullbacks, this 13-year bull market will continue forever – with the proverbial rising tide lifting all boats – then, as we said above, our recommendation is to have no hedge fund exposure and all public equity investments should be in leveraged ETF’s. We obviously do not think that way. Indeed, we believe that 2022 will be “The Year of the Stock Picker,” as Morgan Stanley forecasted in their 2022 US Equities Outlook. The indiscriminate selling that we saw in January is beginning to subside, and we are seeing fundamentals matter more. The issue is having the patience and discipline to see it through and finding managers who can exploit these opportunities. For those investors who think now is the time to put their entire equity exposure in long only or passive strategies, we wish them well. For us, now is not the time to panic or to give up on fundamental analysis.

* * *

Investment Tip: Cybersecurity

While there has been a significant increase on attacks on Ukraine’s cyber infrastructure, we believe the full scale of Russia’s cyberwarfare potential has not yet materialized either in Ukraine or around the world. Unfortunately, many businesses, government agencies, and regulators are scrambling to make up lost ground in terms of vulnerability assessments, patches, and incident response preparations. In mid-February, the SEC released long overdue proposed cybersecurity risk management rules for investment advisers. These measures should have been in place years ago.

As readers of our letters know, we have often used this space in the past to talk about cybersecurity and our enormous vulnerability to cyberattacks – in fact since 2013, we have mentioned the subject at least thirteen separate times. We will continue to pound the drum on the subject and remind people of the risks since we believe it poses one of the largest threats to our national, corporate, and personal security. The events in the Ukraine have been instigated by a country long associated with using cyberattacks as a tool to advance its own interests and one for which cyberwarfare is increasingly becoming one of its most effective weapons of last resort. In our view, the cyber-threat environment has never been worse.

Market Observations

While the recent events in Ukraine dominate headlines, there continue to be trends and events in the markets that deeply cloud our outlook. Looking ahead, some of the things keeping us up at night in the coming year include:

Supply chain difficulties. We have all read about supply chain issues – and many of us have waited months for that new couch or dishwasher. Aside from the associated inconvenience, the problems plaguing the supply chain are having a meaningful impact on economies around the world. In late January, the IMF cited supply chain problems as a factor when it downgraded its forecast for global economic growth for 2022 to 4.4% from 4.9%.

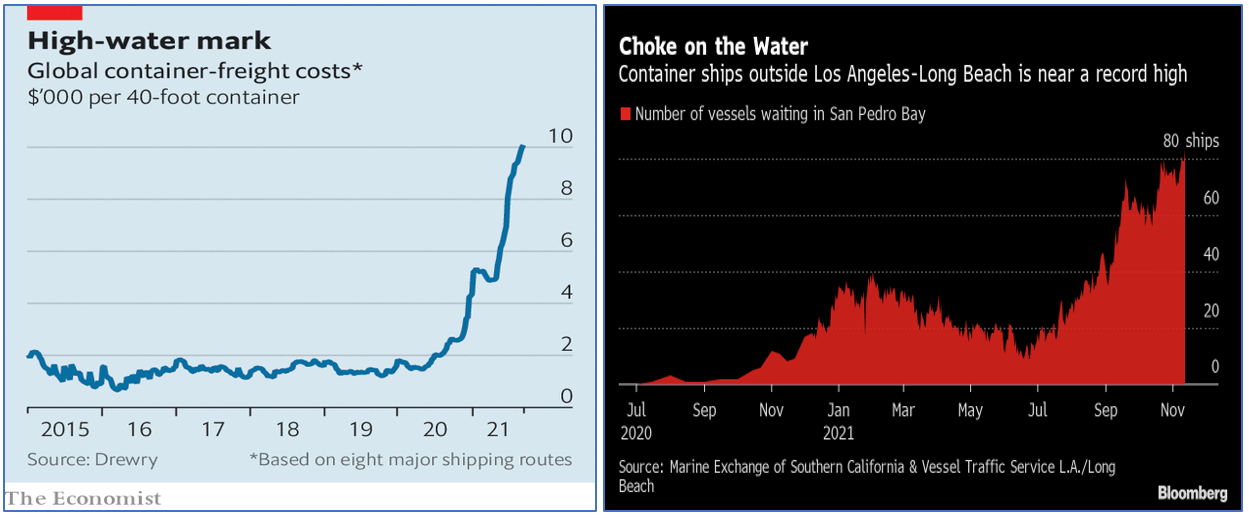

As these charts illustrate, the delay in moving goods combined with steeply rising costs is a double whammy for everyone from consumers to manufacturers. We believe the ripple-on effects of this have not been fully quantified or priced into the current market.

Corporate insiders selling high. Insider sales by corporate executives hit a record of $170 billion in 2021, up from $94 billion in 2020, according to data from SmartInsider. This is not typically a good thing for investors: “One of the most well-accepted facts from decades of research on insider trading is that corporate insiders buy near bottoms and sell near peaks,” said Daniel Taylor, an associate professor at the Wharton School. Indeed, Peloton executives sold nearly $500 million of stock before the company’s big decline, according to a CNBC report in January.

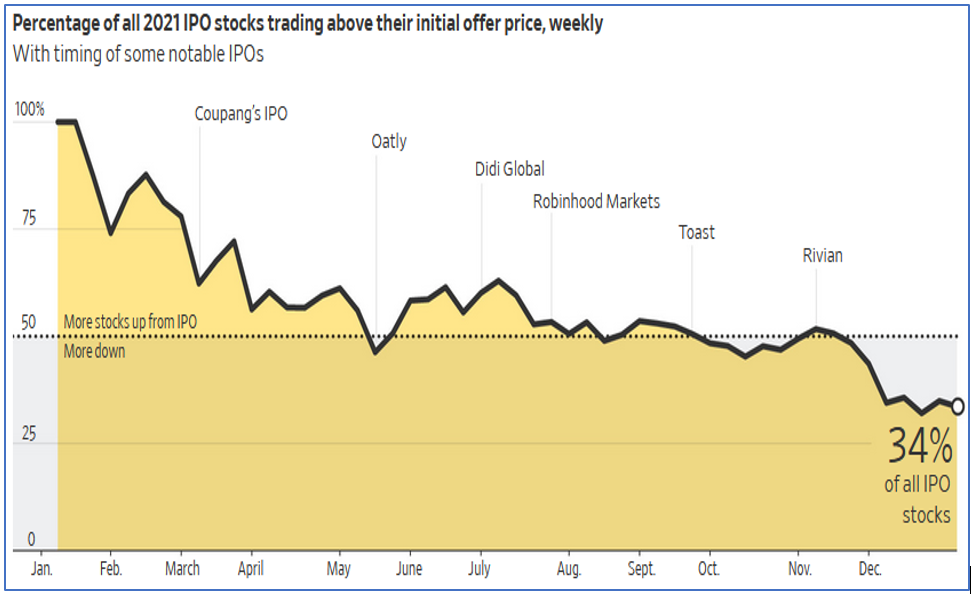

The IPO Market in 2021. Last year, the number of U.S. traditional initial public offerings climbed to the highest level since the late 1990’s and deal value surpassed records, according to Dealogic, as reported on CNBC. In fact, public listings topped $1 trillion in late November, with Rivian’s nearly $56 billion offering briefly making the electric carmaker more valuable than Ford and General Motors. The important question is – how did investors buying IPO’s in the open market fare? Not so well, as the chart below indicates:

Source: The Wall Street Journal, December 29, 2021.

Closing Thought

“Admit nothing, deny everything, and counter-accuse.”

This line was used recently in a conference call held for us by authorities on Russia and global security to describe the country’s misinformation campaign relating to the Ukraine conflict. Among the many troubling insights shared on the call was the view that there are no real red lines in what Russia could do as the country and its citizens experience the full weight of sanctions imposed as a result of the invasion. With Putin recently putting his country’s nuclear deterrence forces on high alert, we feel the line about Russia sums up the disconnect between what is real and what it is portrayed in so many aspects of life today – and not just in Russia. When we think about protecting our families and ourselves in a world rife with threats – whether they be in the form of wars, faltering economies and markets, cyberattacks, or terrorism – and where often nothing is as it seems, we cannot be too careful. For better or for worse, constantly being on guard informs virtually everything we do.

Organizational Updates

We are pleased to report that Phil Villhauer has joined our firm to add to our resources in manager sourcing and diligence and to provide perspectives gained from over thirty years in the markets. Phil has held positions in trading and management at several firms, including most recently Citadel Securities and before that Point72. We have enjoyed a nearly 20-year friendship with Phil and consider him to be one of the most highly respected traders in the industry, with an unparalleled network and experience on the front lines. We look forward to his continuing contributions to AIM13.

We welcome any questions or thoughts you may have.

Alternative Investment Management, LLC (AIM13)