AIM13 Commentary - 2019 Q1

““Whatever is worth doing at all is worth doing well.””

In the current environment for investors, we feel that the risk of doing something wrong looms as large as in any time in recent memory. After the volatility of the fourth quarter, the market surged back in the first quarter, recouping its 2018 losses and posting a new all-time high in April. Unfortunately, we believe many investors came away from the roller-coaster ride of the last six months more emboldened than ever before. Many believe this market will only go up or, at worst, any pullback will look more like a “V” than a hockey stick (or much worse!). The result of this thinking is that more and more investors believe that investing (whether directly or through managers) is easy. We could not disagree more. Unfortunately, we believe there is an “overconfidence problem” among investors today that can lead to the permanent loss of capital. With the wind at their back, many investors today risk doing something wrong that can take many years from which to recover.

While the first quarter represents our second best ever, as noted in our fourth quarter letter, we are not celebrating. With the current economic expansion only a few months short of becoming the longest ever (if it holds through July, it will eclipse in length the economic boom of the 1990’s), we are more concerned than ever about both investment and non-investment risks. Readers of our letters know that we have raised alarms before – one of our favorite sayings is, “always being bearish means you’re never wrong, just early.” Right now, however, for the reasons we outline below, we are sounding the alarm. Investment skill and experience are more important than ever.

* * *

“There’s no reason to become alarmed, and we hope you’ll enjoy the rest of your flight.

By the way, is there anyone on board who knows how to fly a plane?”

- Elaine Dickinson, Airplane! (1980)

As noted in our opening quote, we think that any job worth doing is worth doing well. Investing generally, and investing in hedge funds in particular, is a job like any other and, as such, is worth doing well. However, not everyone has the resources, experience, knowledge, and network to successfully invest in hedge funds. Similarly, not everyone can fly an airplane, much less fly one well. While many of us take for granted what goes on behind the scenes, that does not mean anyone can be a successful hedge fund investor or, for that matter, a pilot. The question becomes, what does it mean to be a successful hedge fund investor?

To answer that question, we must first define success. Our definition of success is to provide superior returns over the long term without risking permanent and material loss of capital. We are happy to be held accountable to that standard, and we believe we have achieved that goal over the last 20+ years.

Unfortunately, many hedge fund investors escape accountability because they do not manage a portfolio of investments (they only invest in isolated funds) or only make recommendations and have no easy way to point to a track record. We do not have that luxury. It reminds us of the exchange in Caddyshack we have used before in these letters. Judge Smails asks fellow golfer Ty Webb (played by Chevy Chase), “How do you measure yourself with other golfers?” To which, he responds, “By height.” We feel many hedge fund investors similarly avoid being held to the right standard.

“Avoiding stupidity is easier than seeking brilliance.”

After we have defined success, we must then consider how we achieve success. As we have said before, we are not rocket scientists (who are much smarter than we are!). We once described what we do as, “Wash, rinse, repeat.” When we hire new analysts, we spend a lot of time on process, focusing on the blocking and tackling. In that regard, we believe a few things about how we invest distinguish us from our peers:

Focus our due diligence more on our current managers, less on finding the next superstar.

Add value to managers, making connections and providing insights, making them better investors.

Leverage our network and surrounding ourselves with smart people.

Invest with managers whose interests are aligned with ours and who view us as partners, not just capital.

Constantly triangulate sources of information. In other words, trust but verify.

Many hedge fund investors invest in hedge funds for the wrong reasons and get out of hedge funds for the wrong reasons. We know our hedge fund strategy is not positioned to fully participate in the upside. However, that does not mean we want this bull market to end – quite the contrary, we would enjoy seeing it go on forever. We just do not think that is realistic, and so we are happy to carry our umbrella. There will be storms, and right now we see many clouds on the horizon.

* * *

A Variation on Our Due Diligence Tips

“Just because you’re paranoid doesn’t mean they aren’t after you.”

Due diligence requires meeting managers, and meeting managers requires travel. So in this due diligence tip, we offer some advice for those of you who, like us, spend a lot of time on the road, whether it be meeting managers or otherwise:

Avoid connecting to public WiFi. Most of us have used some form of public wifi, whether it be at hotels, coffee shops, or airports. Accessing public WiFi allows hackers to position themselves between you and the WiFi connection point. Rather than communicating directly with the hotspot, you are actually communicating with the hacker. This provides access to every piece of information you send, including emails, phone numbers, credit card information, business data, etc. If you must use public WiFi, never access personally identifiable information (PII) such as bank account or credit card information. It is best to use the public Wifi to access a VPN (virtual private network), but if that is not possible, enable the “Always Use HTTPS” option (which you may need to download). This adds a layer of encryption to your connection.

Use a burner phone when traveling abroad. We recently had the opportunity to host Ambassador Hank Crumpton of The Crumpton Group who gave a talk on what worries him most in today’s world. Ambassador Crumpton is a 24-year veteran of the CIA and former deputy director of the U.S. Counter-Terrorism Center. Aside from highlighting the continued threat of terrorism and corporate cyber attacks (discussed below), he offered one piece of advice for when travelling abroad: Do not use your smartphone. In Asia, Eastern Europe, and the Middle East, hackers have become sophisticated enough to allow remote access to your phone and everything stored in it. You might not care about someone surfing your Instagram account, but most of us do not want hackers accessing email or looking over our shoulder when we check our bank accounts using our phones.

Do not connect your phone to your rental car. We were reminded of the dangers of this recently when we picked up a rental car in Manhattan – and then found an acquaintance’s name (and his wife’s and his children’s names) on the car’s user history list. Surprisingly, most rental car companies have no policies to delete sensitive information collected during the rental, according to a report by London-based Privacy International. "Your name and navigation history is valuable personal information," the organization reported. "Combine this information with a bit of open source intelligence, such as social media profiles, and you can track down individuals."

Market Observations

In light of the strong first quarter, we wanted to reiterate our belief that “it’s not only what one makes but how they make it that is important.” There is an enormous amount of risk being taken in the markets today, and we believe that investors’ strong equity returns over the last 10+ years blind many to the fact that markets can reverse very quickly. Indeed, markets tend to fall faster than they rise (some say 3x faster) largely because the fear of loss is greater than the desire for gain. Add this psychological dynamic to the growing presence of “algo” and computerized trading, passive funds, and high frequency trading, the bottom can fall out today much quicker than most investors realize. As noted above, we are more focused on risk-adjusted returns, by which we mean positive returns without taking on undue risk. While we are happy to post strong positive returns, it is more important that we do so maintaining downside protection. How we make returns is just as important as the returns we can generate.

“The less prudence with which others conduct their affairs,

the greater the prudence with which we should conduct our own affairs.”

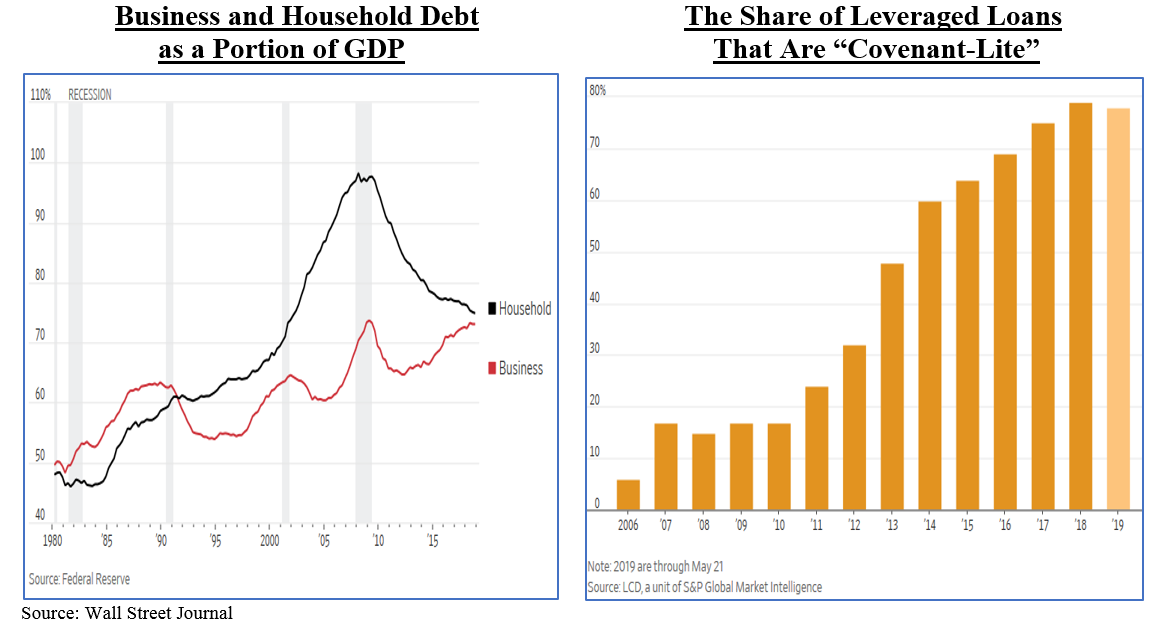

We said above that we are as concerned as ever about both investment and non-investment risks. The list of investment risks is long and includes such things as slowing global growth, trade disputes (China vs U.S.), rising interest rates, inflation, and the inability of monetary policymakers to use tools to combat a recession. However, what we think is most troubling – and which is squarely the focus of the Warren Buffett quote above – is the debt problem in the U.S. The biggest concern in that regard is not necessarily consumer debt (although student debt has grown at an alarming rate), nor is it the national debt. What worries us most is corporate debt:

According to the Office of Financial Research, a Treasury Department bureau created after the 2008 financial crisis, the ratio of corporate debt to GDP is the highest since records began in 1947. This is combined with an unprecedented loosening of lending standards, as the chart on the right above illustrates. The worry about corporate debt is that once earnings start to slide, weaker companies will not be able to service their debt. This could create a domino effect on the entire economy.

In the bucket of non-investment risks, some things that worry us include:

Cyber Attacks. We recommend watching the 60 Minutes segment that aired earlier this month regarding the sharp spike in ransomware attacks. The prevalence and sophistication of the hacks is truly frightening. Just this month, the city of Baltimore became the latest publicized victim of a ransomware attack. (As of this writing, the city apparently is refusing to pay the ransom.) Less reported are the risks to corporations that are targets of ransomware. One reason this remains under the radar is that many firms elect to quietly pay the ransom (and not report the attack) because of the negative publicity associated with being hacked.

Not surprisingly, ratings agencies are now beginning to factor cybersecurity into a borrower’s credit worthiness. In a report issued in February, Moody’s said that “Data disclosure and business disruption are the two primary types of cyber event risk that we view as having the potential for material impact on issuers’ financial profiles and business prospects.” In fact, Moody’s slashed Equifax’s credit rating on May 22, the first time a company was downgraded because of cybersecurity issues.

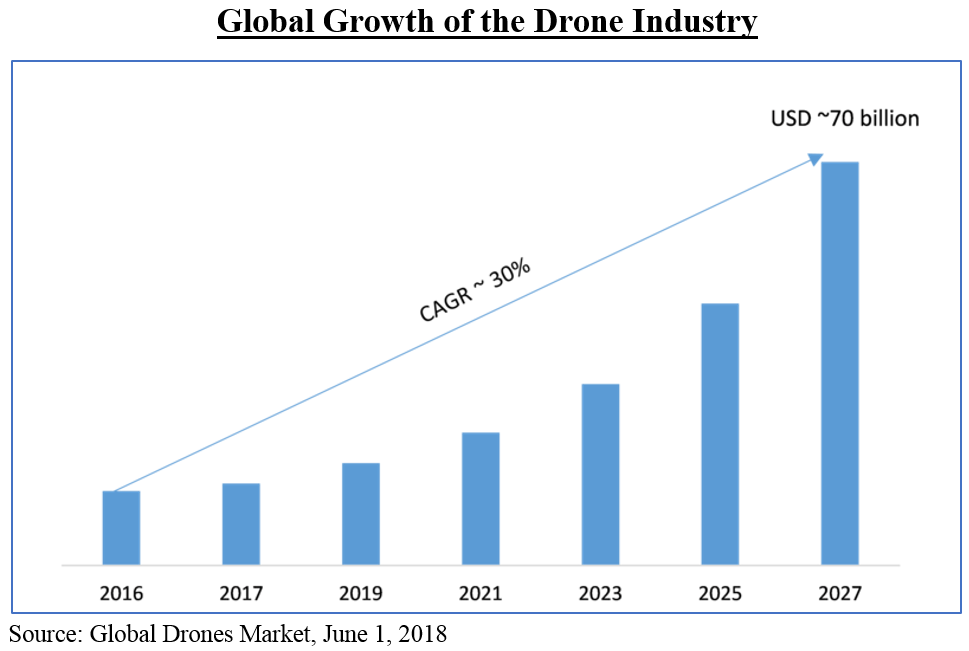

Drones. When Yemen’s Houthi rebels used drones to strike Saudi oil facilities in mid-May, many were caught off guard by how vulnerable critical infrastructure can be to damage by such “UAV’s” (unmanned aerial vehicles). Ever increasing “bad drone” incidents – such as the assassination attempt on the president of Venezuela last August or the closure of Gatwick airport in December – reinforce the risks associated with the explosion of drones. In early 2018, the FAA announced that their drone registry had topped one million drones for the first time. While most of those were owned by hobbyists, the FAA expects commercial drone numbers to quadruple by 2022.

We have been following the development of drones closely for some time, since we believe they will create enormous disruption – both positive and negative – in a wide a variety of ways. Just like most people, we welcome such innovations as Amazon deliveries to our doorstep via drones. However, we are more worried about drones in the hands of those who want to do harm, rather than good.

Terrorism. While we have not written recently about the risks of terrorism, it is worth raising here since cyberattacks and drones are just two tools bad actors can use to cause enormous loss of money or (much worse) loss of life. We are particularly concerned these days given that a wave of criminals convicted of committing or supporting terrorism after the 9/11 attacks is starting to leave prisons and jails. Among them is John Walker Lindh, the “American Taliban,” who was released on May 23. This coincides with the rise in home-grown, domestic terrorism (compared to international terrorism), as reported by NPR earlier this month. The FBI currently has nearly 5,000 open terrorism investigations, according to the NPR report. "Eighteen years after 9/11, we don't want Americans to forget that the threat is still very real," one FBI official said.

* * *

Closing Thought: The U.S. May Be Losing Its Competitive Edge

“I live at home with my parents. It’s just temporary… until they die.”

During this season of graduations, we are reading more and more about recent college graduates entering the job market with work-life balance expectations that we think may be unrealistic in today’s highly competitive, global market. Many young workers in the U.S. expect a four-day, in-office work week (with one day work from home) and remain at home so that their parents can cover daily necessities (like room and board). Financial literacy in the U.S. is also in decline. CNBC reported in May that among Americans age 18 to 29, credit card delinquencies of 90 days or greater surpassed 8% of balances in the first quarter, hitting an eight-year high.

We are worried that other parts of the world are out-working us. Jack Ma, the energetic founder of Alibaba Group, made headlines in April for praising China’s work-hard culture embodied by the “996” schedule (working 9am to 9pm, six days a week). That may be an extreme, but it illustrates a work ethic that is different than ours. Similarly, according to a recent survey done by Kronos, the workforce management company, when workers around the globe were offered to work less and make the same amount of money, 69% of Indians said they were willing to keep working a five-day work week and be paid more, as opposed to only 27% of American who would opt to work the same and earn more. In other words, nearly three-quarters of Americans would simply work less.

The trends of the U.S. work ethic falling behind other countries is coupled with an ever-increasing “brain drain” – non-U.S. students returning to their native country after obtaining a valuable U.S. education. According to a recent report on CBSNews.com, the global talent that America attracts to its universities is increasingly looking to succeed elsewhere in part because it keeps getting harder for U.S. firms to hire and keep foreign talent. A study by the National Association of Colleges and Employers found that fewer than one in four U.S. companies plan to hire foreign workers – which is particularly astounding when one considers that half of the Fortune 500 companies in America were founded by first or second generation immigrants. All of these factors add to our growing concern that the U.S. may be losing its competitive edge.

We welcome any questions or thoughts you may have.

Sincerely,

Alternative Investment Management, LLC