It Is Time for LPs to be Accountable...

“Blaming others for your problems is like blaming donuts for being fat.

It wasn’t the donut, it was the choice. ”

We have been investing in private equity for decades and have always favored general partners (GPs) who view their limited partners (LPs) more as “partners” and less as “limited.” Recently, however, we have seen more and more GPs propose limited partnership agreements (LPAs) that are increasingly GP-friendly. Law firms are willing co-collaborators since by and large they service the GP community. The time has come to call out these practices and demand change.

What puzzles us the most is that by and large LPs are not pushing back. Even worse, where are the large fiduciaries on this issue? The big state pension funds and other large allocators have the negotiating power, so why are they signing up for these terms? LP groups such as the Institutional Limited Partners Association (ILPA) have been telling the SEC about certain abuses in the industry, and the SEC continues to focus on this. However, at the end of the day, it is the LPs who sign these LPAs and, to quote Nancy Reagan, sometimes LPs need to Just Say No!

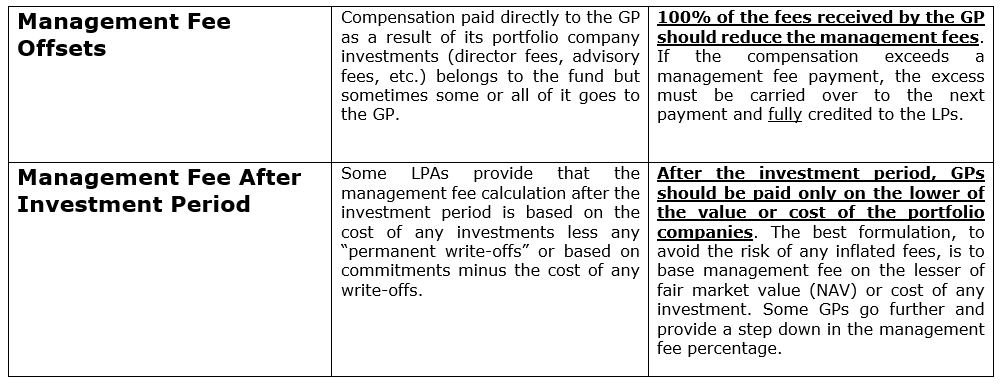

We wanted to highlight a few things that particularly illustrate how private equity GPs are skewing things in their favor:

There is obviously no perfect LPA, and the best agreements align the incentives and the risk/rewards for all parties. For example, managers should not be incentivized solely to invest the capital, regardless of the quality of deals they can find.

At the end of the day, LPs need to answer a simple question: Is the expected NET return acceptable and will it outweigh any terms that are GP-friendly? Top managers can charge top fees and negotiate onerous terms (as long as they deliver), but they should not be paid for just showing up. In our experience, GPs who provide transparency, are reasonable on fees/expenses, and treat their LPs as true partners usually are the ones who generate the best long-term returns.

* * *

Readers of our letters know that we are always looking for ways to improve and identify best ideas. In that regard, we hope these suggestions will prompt a broader discussion among private equity investors and GPs that will make private equity investing more rewarding for everyone. Please email and share any feedback with us at PE@AIM13.COM. Thank you!

Alternative Investment Management, L.L.C.

www.aim13.com

(212) 557-6191